Written by Jan Nieuwenhuijs, originally published at Gainesville Coins.

Sturdy central bank gold buying since 2009 and a rising gold price has grown the precious metal’s share of global international reserves to the detriment of fiat currencies. By the end of 2023 gold surpassed the euro and the next fiat currency to be challenged is the US dollar.

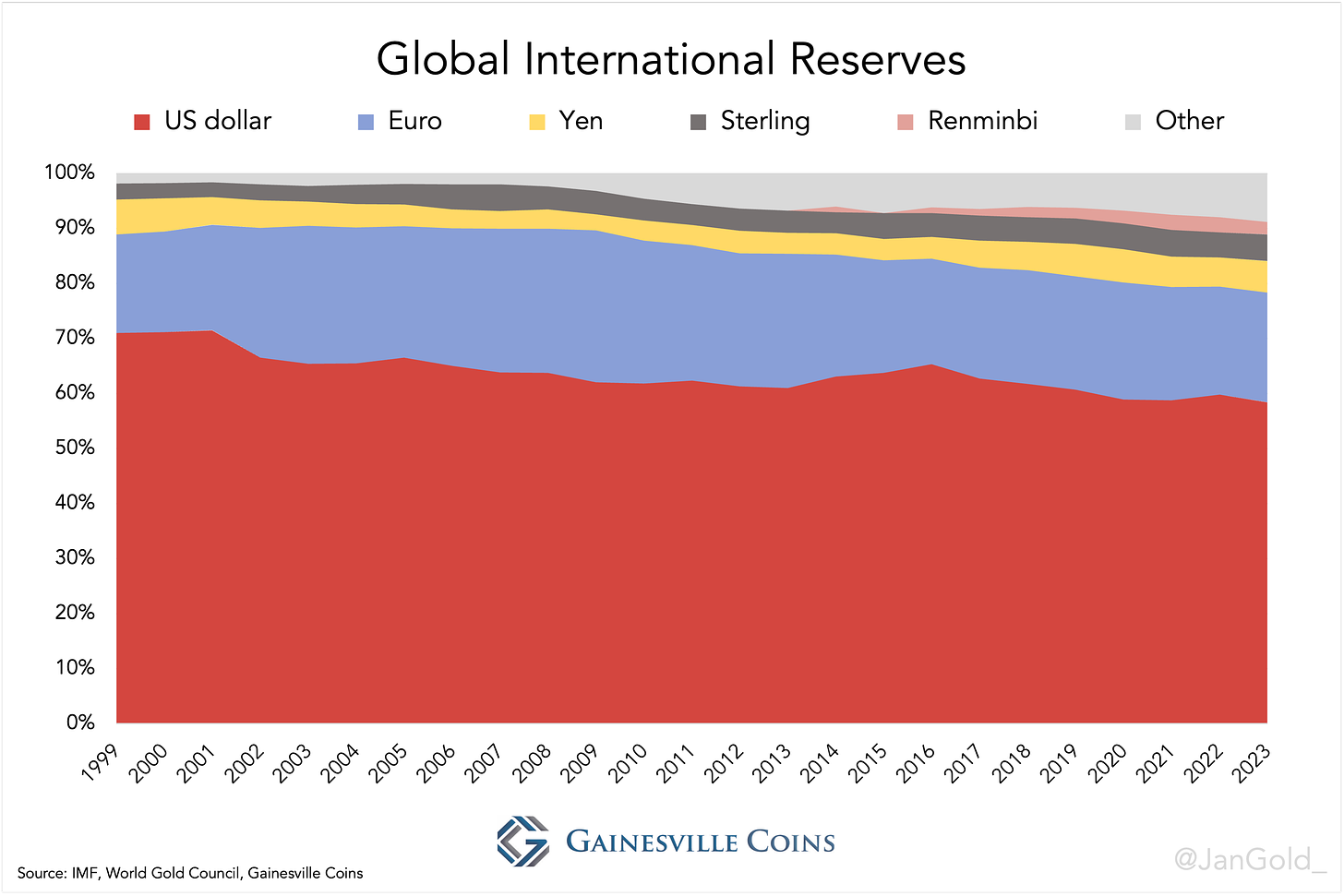

Often when financial analysts draw charts on the distribution of international reserves they focus on foreign exchange (omit gold) and start when the euro was introduced in 1999. Based on such charts the dollar’s share of total reserves appears to be falling slowly, from a peak of 72% in 2001 to 58% in 2023. In addition, it seems there is not one specific currency that is competing with the dollar.

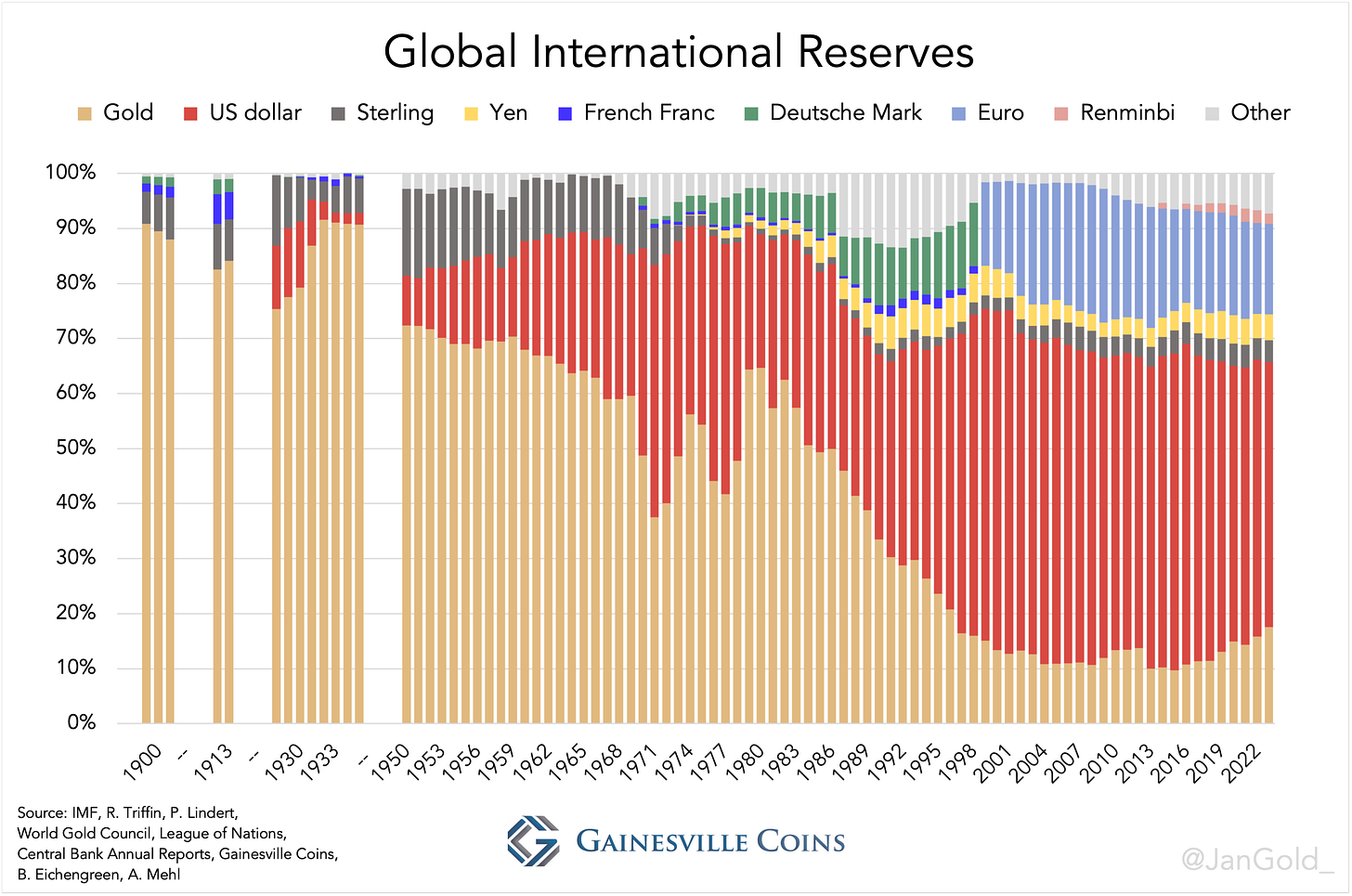

But why not include gold and look back as far as possible? By combining multiple sources, we get a glimpse of the dissemination of reserve currencies from 1899 until 1935 (both fiat and gold), and a full picture starting from 1950.

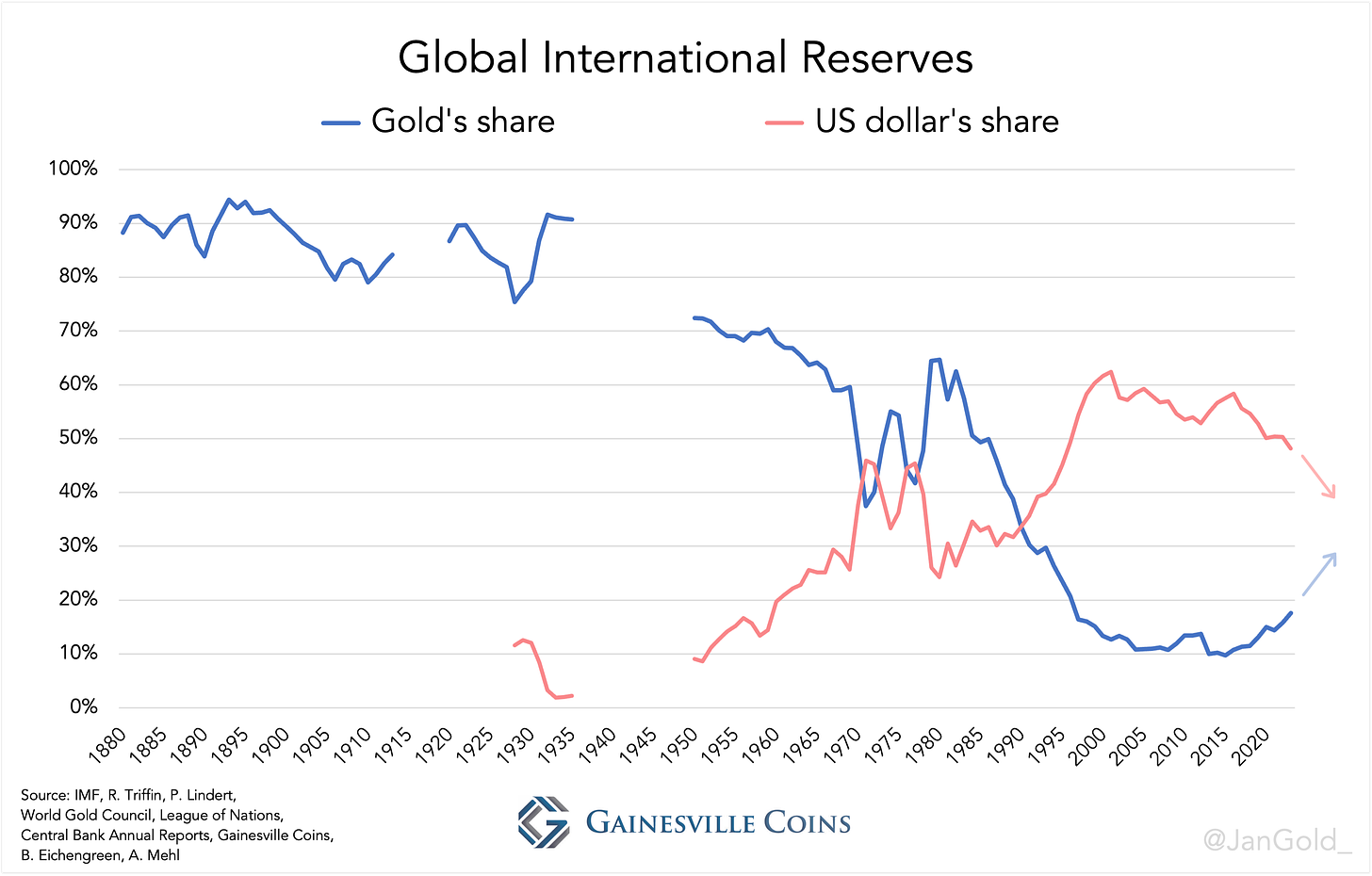

This paints a whole different story. Instead of showing only the demise of the dollar at snail pace, the historic balance between gold and fiat currencies is revealed. It’s not the dollar that normally backs the international monetary system, it’s gold. Gold used to make up the majority of international reserves, even when sterling was said to be the world reserve currency before the dollar. In a chart covering more years but only gold and the dollar, the latter’s reign becomes even more relative.

The above chart displays that the dollar’s share of total reserves has fallen to 48% in 2023—caused by a declining trust in “credit assets” (fiat currencies), due to worrying asset bubbles, escalating wars, and fear of inflation—while gold is making ground.

Based on personal calculations of official gold reserves that include covert acquisitions, for example by the Chinese central bank, gold's percentage of total reserves reached 18% in 2023, up from 11% in 2008. Gold has currently surpassed the euro, which got stuck at 16%. As the problems haunting fiat currencies won’t fade anytime soon it’s possible gold will overtake the dollar as well in the decade ahead (explained more detailed here).

Be sure not to miss the X-post below that includes a video illustrating the development of reserve assets since 1950 in a bar chart race (link in captions)!

These graphics beg the question: what happened to gold in the 1970s, 1980s, and 1990s? It was rejected emphatically in favor of fiat currencies. The question is this: do most countries feel they have benefited from this change, or do they regret the move?

I think we're in the midst of a tectonic shift away from dollar dominance. Political changes in the US could slow, or even reverse the trend. The current crowd is hoovering up as much of the world's wealth as they can, jockeying for position before the next world war rearranges the board.