Written by Jan Nieuwenhuijs, originally published on Gainesville Coins.

The story on the emergence of the US dollar hegemony.

After the collapse of Bretton Woods in 1971 several European central banks tried setting up a new gold pool to stabilize the price and move to a quasi gold standard. The US wanted to phase out gold from the system and enforce a dollar standard on the world.

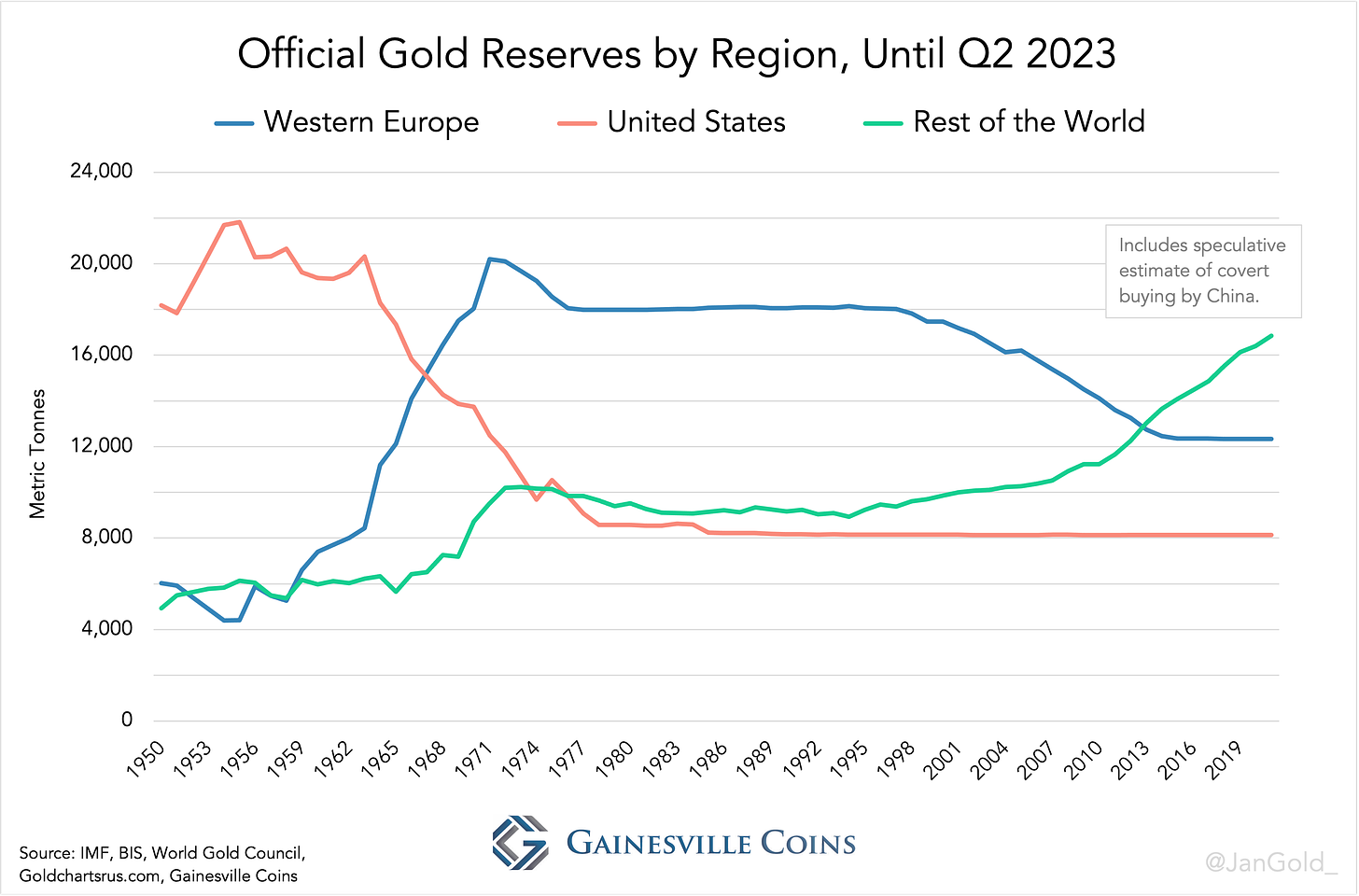

What frightened the US was that Europe held the most gold and alluded to raising the gold price periodically to create liquidity, giving them the dominant means of creating reserves. Through its military presence in Germany, protecting it from the Soviet Union, the US was able to pressure the Germans not to cooperate with the gold pool. Without Germany the other European countries couldn’t materialize the pool and gold lost its anchor role in the monetary system. In the meantime, the US made a secret deal with Saudi Arabia to recycle oil dollars into US government bonds.

The United States didn’t manage to phase out gold from the system altogether, but it did succeed in establishing a global dollar standard which yielded them unprecedented power.

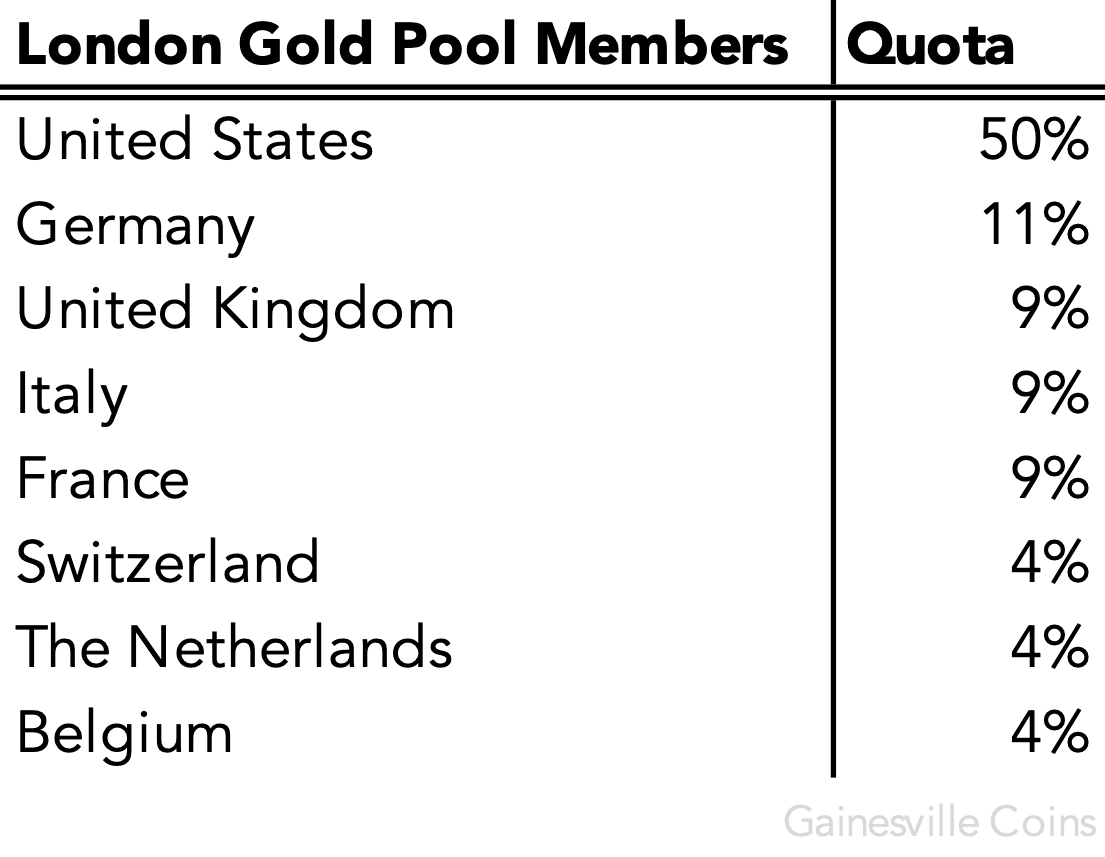

For the sake of simplicity “Europe” will generally refer to Belgium, France, Germany, Italy, the Netherlands, and Switzerland, most of which also cooperated during the classic gold standard in the 19th century.

The Beginning of the End

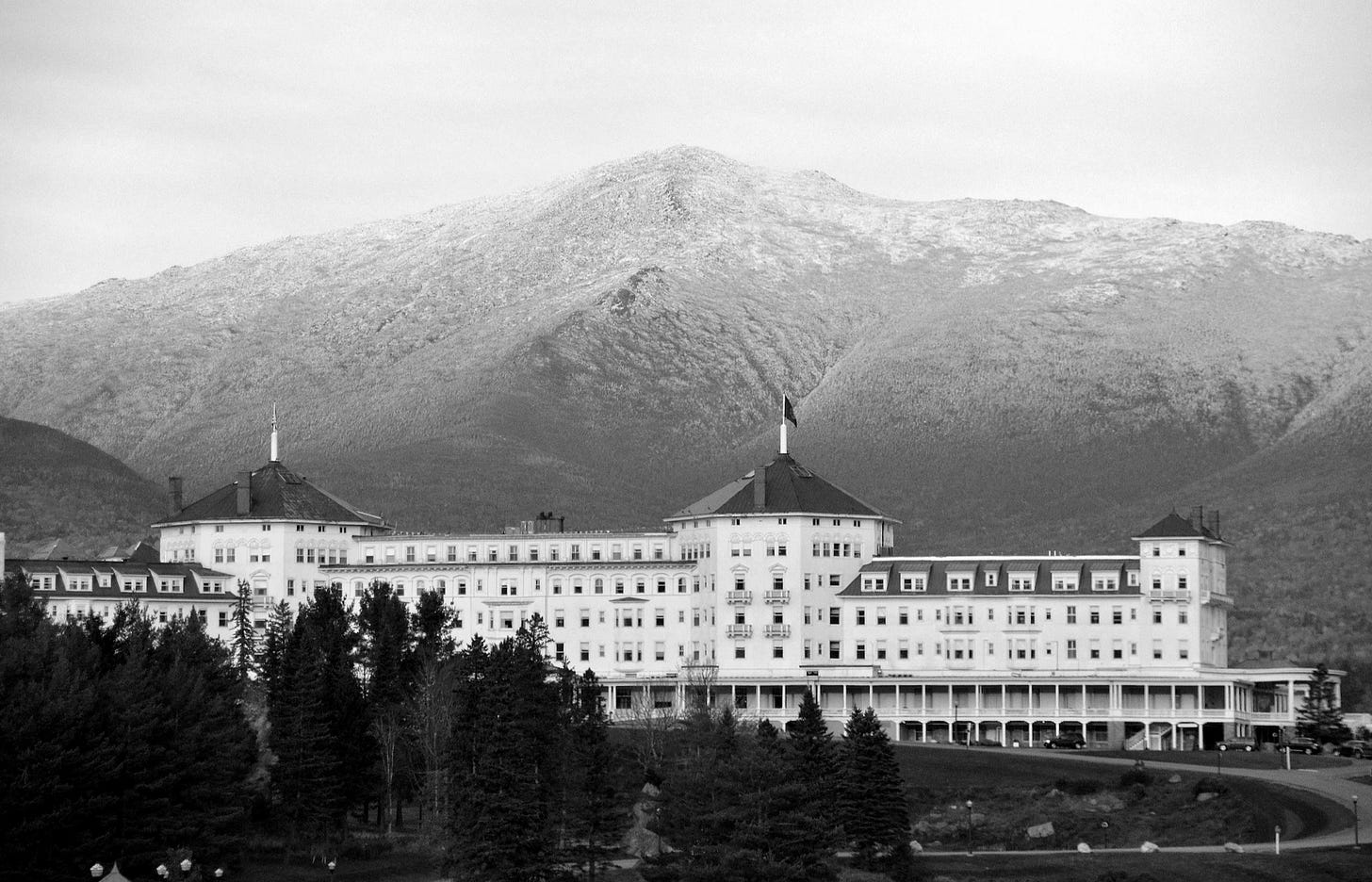

At a conference in Bretton Woods, New Hampshire, in July 1944, no less than 730 delegates from 44 nations forged a new international monetary system. With the currency wars of the 1930s in fresh memory an agreement of fixed exchange rates and free trade was reached. Because the United States had the strongest hand at the negotiation table, only the dollar was convertible into gold at $35 per troy ounce, making it "as good as gold" and stimulating its use as a reserve currency. Other currencies were pegged to the dollar (or gold). Gold was thus the ultimate anchor of "Bretton Woods," granted by the Federal Reserve that was obligated to convert (buy and sell) dollars into bullion for foreign central banks.

While pound sterling was still held by central banks the world over from the previous arrangement, Bretton Woods incentivized central banks to hold dollars and gold as reserves. An advantage of the dollar, relative to gold, was that it accrued interest; a disadvantage was that it could devalue against gold (or be seized). In practice, the system created demand for dollars as a trade, intervention, and reserve currency.

The “rules of the game” were enshrined in the Articles of Agreement of the newly erected International Monetary Fund (IMF) that was to administer the system and support countries with temporary balance of payments deficits through lending reserves. In consultation with the IMF countries could devalue (revalue) their currency in case of chronic balance of payments deficits (surpluses) to restore equilibrium. The system was stable as long as its members implemented similar domestic monetary policies (countries with relatively loose policies had to devalue), which didn’t happen.

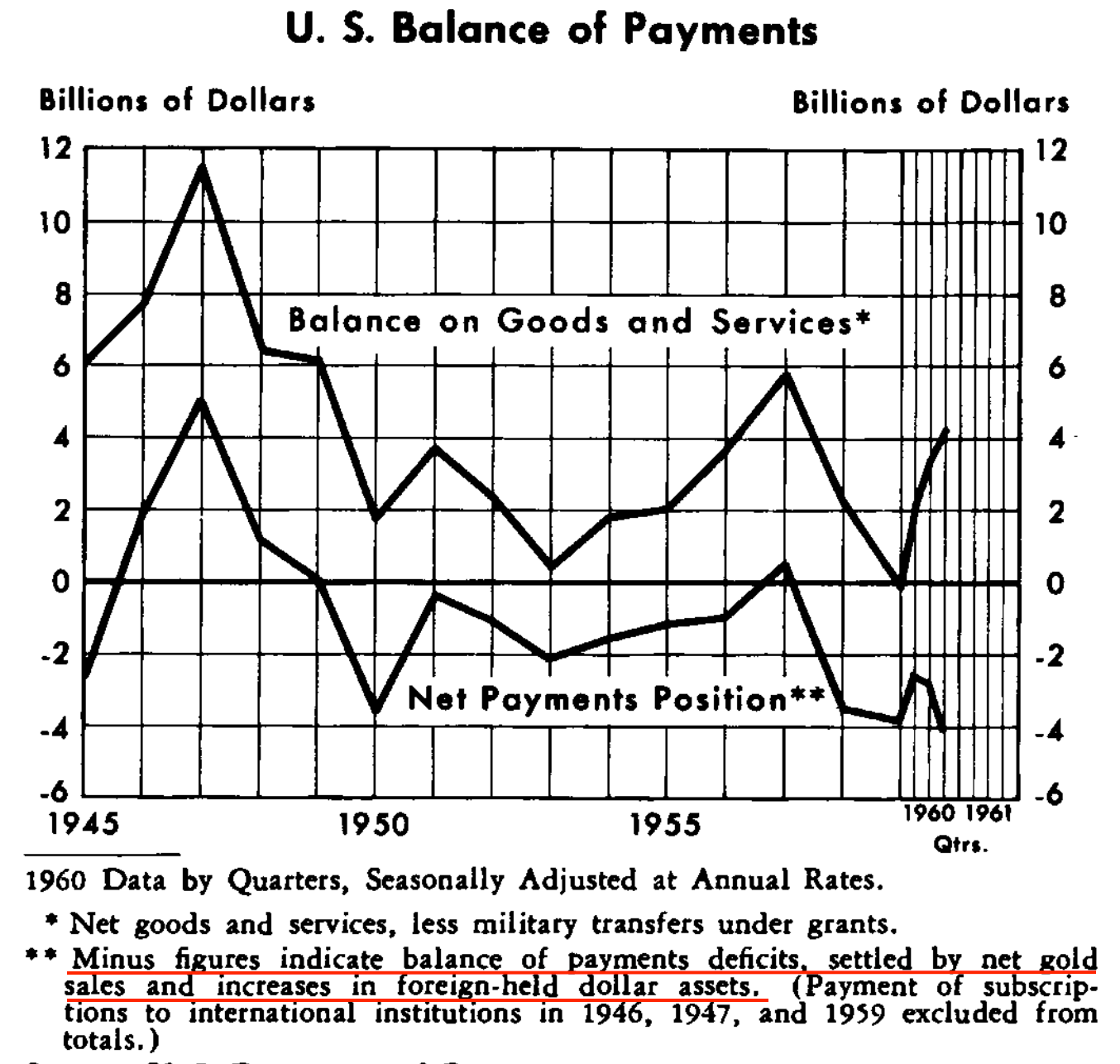

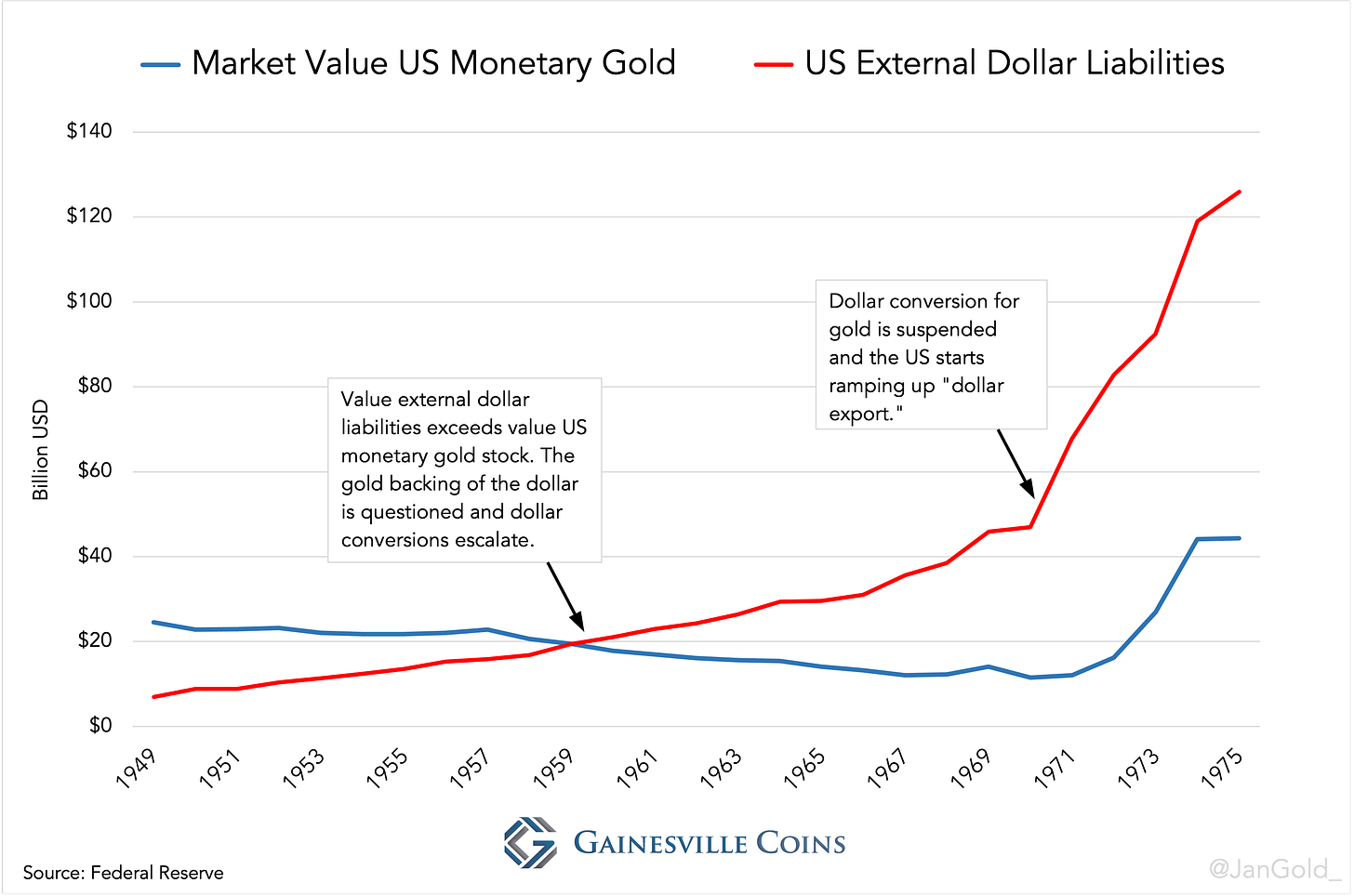

In the late 1950s the United States' balance of payments deteriorated, resulting in a buildup of dollar balances held abroad, and, as central banks could convert dollars into gold, a decline of the US’s monetary gold stock. At first an increase in the supply of dollars abroad was welcomed because it inflated international liquidity beyond the growth of gold supply. Though, in 1960 the United States’ external dollar liabilities exceeded its monetary gold holdings, which prompted global concern. A run on the dollar could coerce a devaluation or default of the US.

In November 1961, President of the Federal Reserve Bank of New York, Alfred Hayes, presented a plan at the Bank for International Settlements (BIS) in Bazel, Switzerland, to collectively defend the price of gold at $35 dollars an ounce in the free market (Bordo et al 2017). European central banks assented to form a Gold Pool with the US—buying and selling gold in the London Bullion Market to keep the free market price close to the official price—and protect the international monetary system from disintegrating. France accepted to join on the condition the US would restore its balance of payments deficit (Avaro 2022).

Although the new club started as a secretive syndicate, it didn’t take long before the Pool’s operations were leaked to the press to amplify its impact. On March 8, 1962, the Pool was first covered by Le Courrier de Genève (Bordo et al 2017, Naef 2022). Creating public awareness likely worked in its maiden years of existence when the Pool was a net buyer of gold. But as the US started printing more money to finance the war in Vietnam throughout the 1960s, downward pressure on the dollar mounted. The Pool was challenged in its bluff selling gold.

In February 1965, the President of France, Charles de Gaulle, gave a speech in which he conveyed his criticism of Bretton Woods and America’s “exorbitant privilege”: to the extent countries were willing to hold dollars in reserve, the US could print dollars out of thin air to pay for imports and make investments abroad. In reality, Bretton Woods was designed for the world to accumulate dollars. Additionally, the inflationary policies of the US in the late 1960s were exported abroad through its balance of payments deficit and fixed exchange rates, pushing foreign central banks to buy dollars with their printing presses (Dibooglu 1999, Bordo et al 2017).

According to De Gaulle, international settlement should be done in gold and the use of reserve currencies had to be limited. De Gaulle and his economic advisors foresaw a dollar crisis advancing. To protect itself from devaluation France ramped up dollar conversions into gold at the Fed, in part to supply the Pool.

Shortly after, Belgium and France expressed their doubts about the viability of the Pool at BIS meetings (Bordo et al 2017). European central banks didn’t want to defend the dollar-gold peg indefinitely for what was essentially a problem of the United States. France dropped out in June 1967 when the Pool’s resources needed to be increased (Avaro 2020).

In November 1967, Great Britain was forced to devalue pound sterling. If sterling could fail, so could the dollar, the market reckoned. Slowly but surely things started spiraling out of control and the Pool was confronted with significant losses. “The gold markets were faced with numerous bouts of speculative buying in late 1967 and early 1968,” the Federal Reserve Bank of Dallas remarks in its 1968 annual statement. From March 8 through 14, 1968, the Pool sold nearly 1,000 tonnes of gold. “US air force planes rushed more and more Fort Knox gold to London, and so much piled up in the Bank of England’s weighing room that the floor collapsed,” writes Timothy Green in The New World of Gold.

Belgium and Italy also became anxious to opt out as their gold reserves contracted (Green 1973 135). It became senseless to sell gold into a black hole. The next day, on March 15, 1968, the London Bullion Market was closed for two weeks at the behest of the US. Quickly the central bankers of the Pool flew to Washington for a conference.

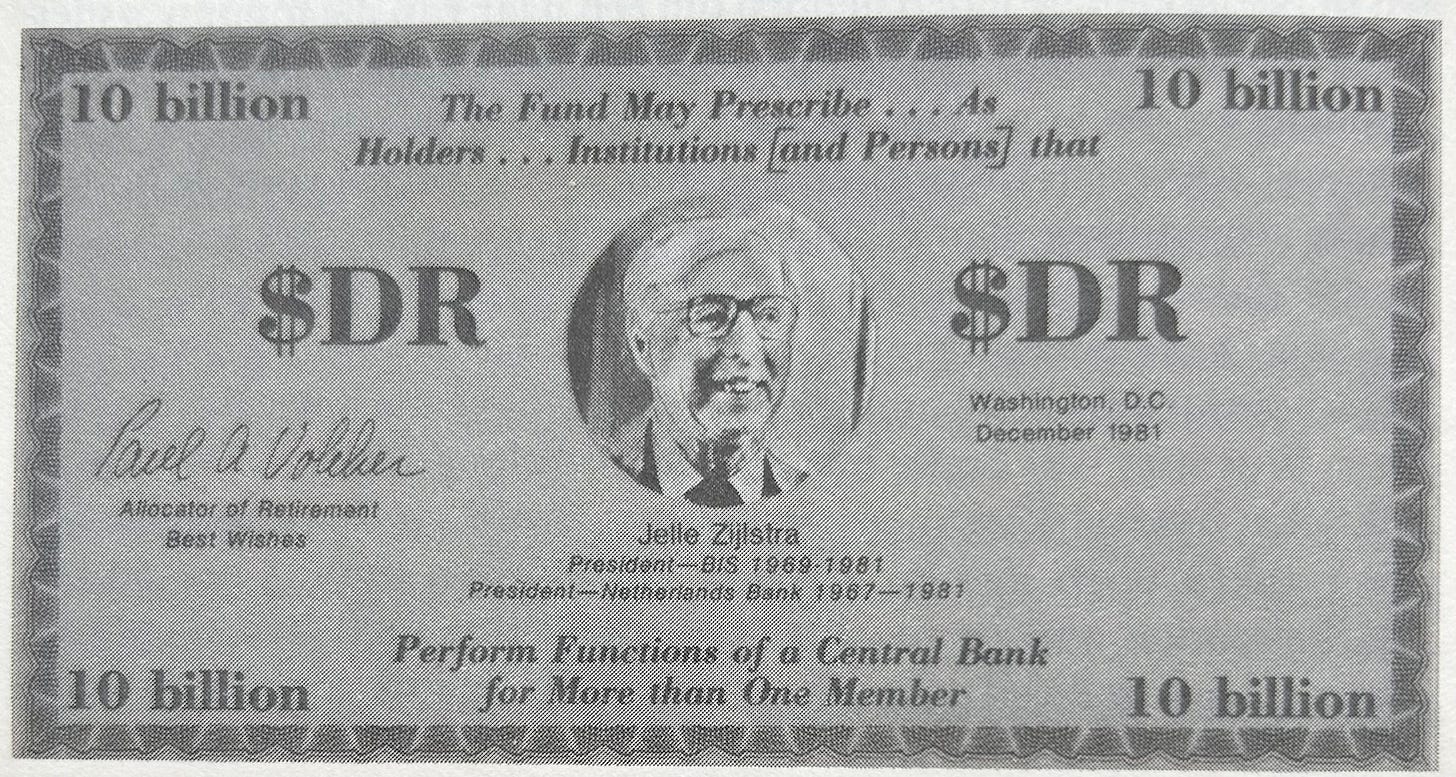

A prominent person at that time was Jelle Zijlstra, President of the Dutch central bank and Chairman of the BIS from 1967 until 1981. Zijlstra writes the Europeans had a different interpretation than the US from the agreements reached in Washington (Zijlstra 1978 191):

The Washington conference of March 1968, … gave rise to many difficulties afterwards, because almost from the outset the decisions taken there were interpreted in two very different ways. Some countries were of the opinion that the only decision taken in Washington was to abolish the gold pool, to stop gold sales by central banks in the free market in order to keep the free market gold price close to the official price. The Americans took the position that it had also been decided that the central banks would never again buy gold on the free market, or in other words, that a first step had been taken towards the removal of gold from the international monetary system, the so-called demonetization of gold.

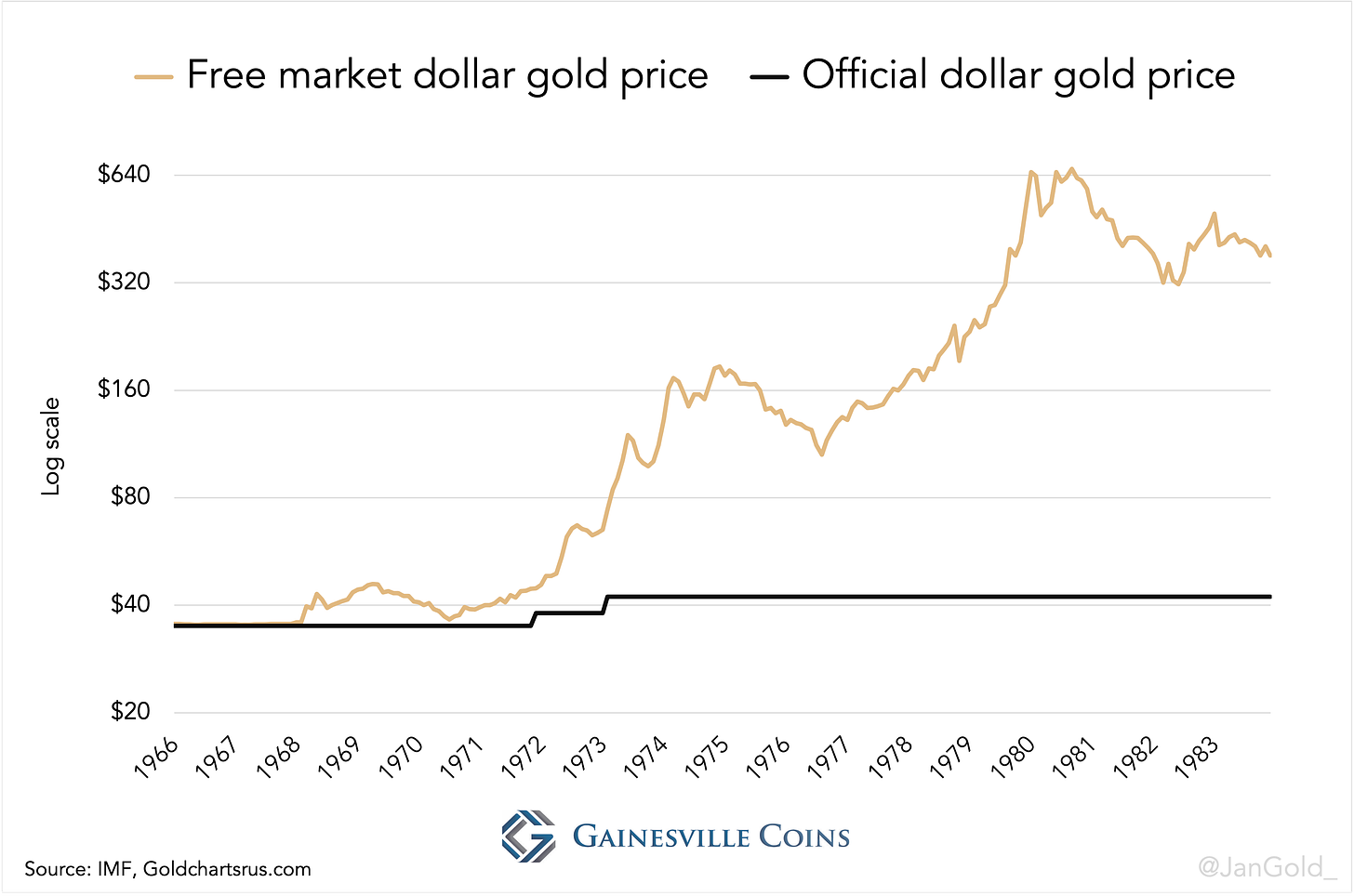

Clearly, the communique from the conference doesn’t state that central banks would never again buy gold from the free market. In any case, the Pool was disbanded and the free market price of gold allowed to float.

In favor of the Americans, the IMF’s Articles of Agreement (Article IV Section 2) stipulated that no central bank would buy or sell gold at a price other than the official price. And so, as a consequence from the Pool’s moratorium, a two-tier gold market was born. Private entities could trade gold at the free market price and central banks could transact at the official price.

This setup subsided the role of gold in the international monetary system, as it severed the link between gold production and other sources of gold and monetary reserves. Gold also became increasingly illiquid, because no central bank wanted to sell at $35 an ounce knowing gold was worth much more. Gresham's Law assured the use of the dollar as intervention and trade currency by its presumed overvaluation with respect to gold (Mundell 1971 13). The world began creeping towards a dollar standard (Bordo 1993 4).

Europe got cornered. By then they held the largest gold reserves, and it would have been a pity, to say the least, to render it useless.

Zijlstra’s solutions to resuscitate Bretton Woods were simple. The official gold prices in all currencies should have been raised to increase global liquidity and make sure the dollar would stay convertible into gold (Zijlstra 1978 190). He adds, “it was curious that in the post-war world, where everything was at least three to four times more expensive than in the 1930s, the gold price had remained unchanged” (Zijlstra 1992 222). In addition to the first measure the official gold price of the dollar should have been raised even more, thus devaluing the dollar against all other currencies to restore the United States its balance of payments. “However, the Americans opposed both solutions tooth and nail. … After all, this would put the dollar in second place to gold, and the Americans’ ideal was and is for the dollar to play a central role on the economic stage” (Zijlstra 1978 191, 1992 222).

The Heat is On

European central banks continued converting dollars at the Federal Reserve, whilst the Americans tried to block such requests.

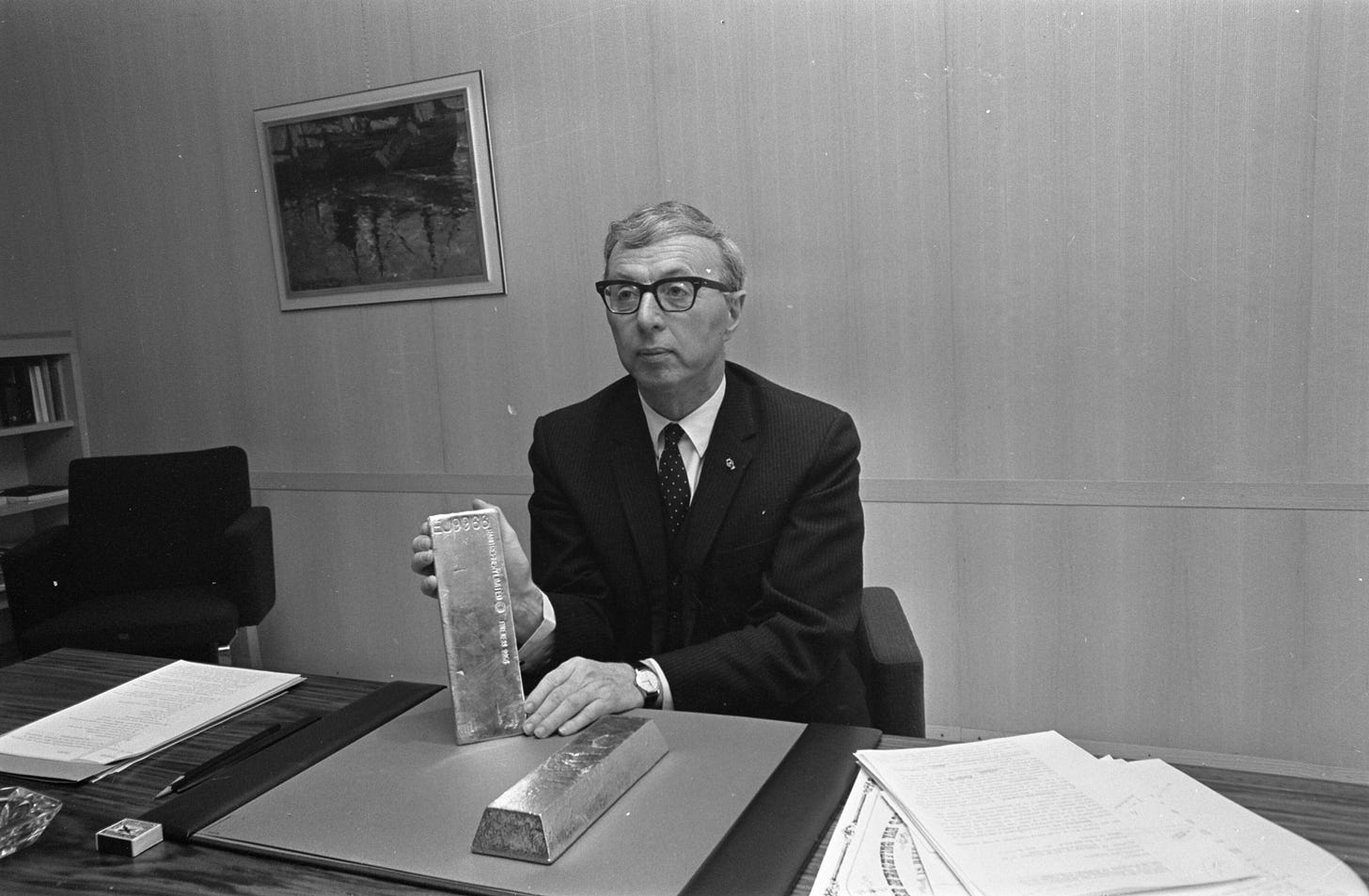

As shown in chart 6, Germany held less of its total reserves in gold than its European peers. Having American troops on its soil, protecting Germany from the Soviets, came at a cost: not being allowed to convert dollars at the Fed. Germany held large gold reserves, but this was mainly obtained via trading partners in Europe (Bundesbank 2018 99).

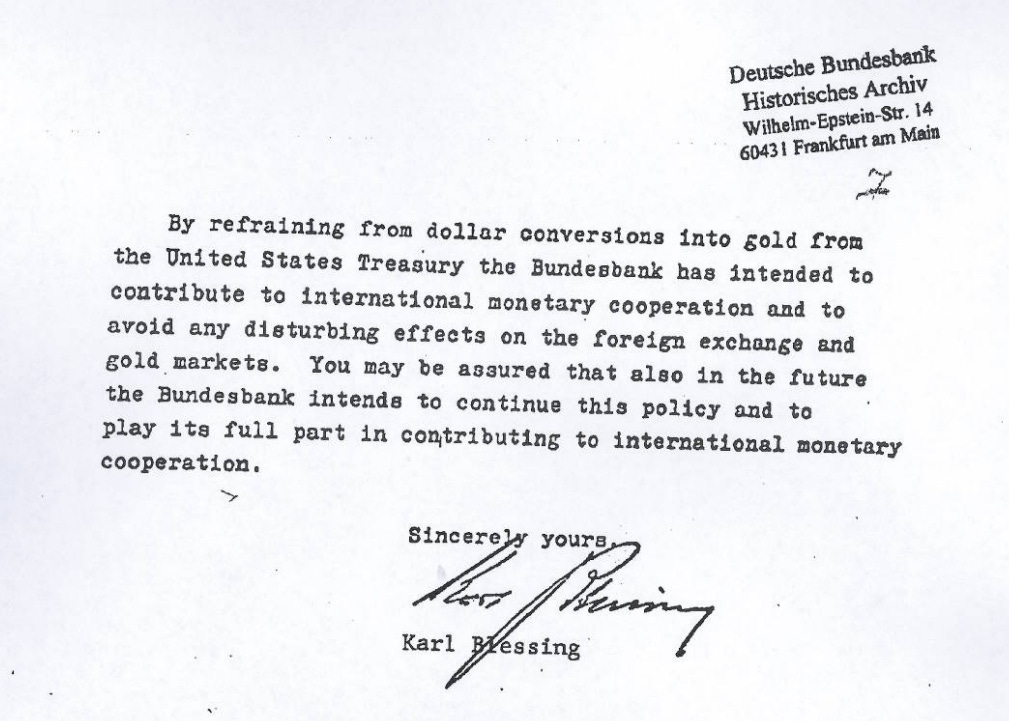

Germany’s commitment not to convert dollars was sealed in a letter to the Fed, dated March 30, 1967, by Karl Blessing, President of the German central bank (Bundesbank). Blessing also concurred to invest $500 million dollars in US government bonds, financing both America’s balance of payments and fiscal deficit.

Shortly before Blessing died he gave an interview published in Der Spiegel:

BLESSING: … the threat was always in the background. Former US High Commissioner McCloy once visited the German government and said: “Look, we've now had a Senate decision; there is soon a majority that we will withdraw our boys. We have to do something.” So, he called me at home on a Sunday afternoon at half past three and said: “I have to fly back tonight, can't we see each other?” And I said to him: “My dear McCloy, your situation is clear, this is a balance of payments problem for you, nothing more. You have seen that we are sensible and do not convert our dollars into gold. I am even willing to give you that in writing for a certain time.” Unfortunately, the letter that I wrote back then is still valid today.

I should have been more rigorous with regard to the US. The dollars that we were accumulating should simply have been rigorously converted into gold.

Other European countries were better off. In one of his books Zijlstra describes how he was pressured by the Americans but stood his ground. From Zijlstra (1978 191):

That the mood was becoming more threatening became apparent to me when on July 7, 1971, the US Deputy Secretary of the Treasury, Paul Volcker, and my American colleague, Dewey Daane, came to visit me in Amsterdam [the Netherlands]. They urged me to cancel the exchange of $250 million into gold. We had already exchanged nearly $600 million worth of dollars into gold … since the beginning of 1971. The fact that such a heavy delegation came to Amsterdam to ask me to refrain from conversion was the clearest proof to me that the storm was really about to break. I explained that I could not comply with their request. We held dollars only up to an amount that we considered working stock. Everything above that we wished to exchange for gold …. Volcker then said to me, “You are rocking the boat.” My response was: “if that boat rocks too violently as a result of converting $250 million, that boat has already sunk.”

All along the intent of the Americans was to phase out gold from the international monetary system; for the rest of the world to import their dollars and hold as reserves so the US could live beyond its means and secure the dollar hegemony. Illustrative of this scheme is an action memorandum from Henry Kissinger, the US President’s Assistant for National Security Affairs, to President Richard Nixon dated June 25, 1969. “We can try to finance our deficits,” Kissinger wrote, to “borrow implicitly by inducing other countries to build their dollar holdings. At the extreme, this would mean getting (or forcing) the world to go onto a ‘dollar standard’.” In international economics holding foreign exchange as reserves is a loan to the issuer of that money because technically that issuer still has to settle a trade imbalance with something real.

Primarily “the [dollar-gold] convertibility link,” was blocking the United States’ agenda, as noted by a Volcker Group Paper from 1969. The paper continues:

Perhaps one of the most important long-term problems facing the US is how to move out of this commitment in a graceful manner without causing undue disturbance to the monetary system and with a fair measure of international approbation, at some time in the future. It is not yet clear whether this can be done, and a breaking of the link may have to come in the context of some crisis and a threatened run on the dollar.

A run on the dollar, from the viewpoint of the US, arrived early August 1971 when both the British and French called on the Fed to redeem more dollars (Bordo et al 2017). Finally, on August 15 President Nixon announced to temporarily suspend dollar convertibility, although this has never been reactivated. The “Nixon Shock” de facto terminated Bretton Woods and one can imagine countries holding dollars were not amused. Kindly note, in chart 2, how external dollar liabilities of the US exploded from then on.

At the same time, European countries, trading a great deal with one another, were integrating through the European Economic Community (EEC) and introduced their own framework for managing exchange rates (aimed to progress toward a monetary union) called “the snake.” A unified Europe showed the world its strength and leadership. Kissinger said to Deputy Secretary of the Treasury, William Simon, at one point: “I basically have only one view right now which is to do as much as we can to prevent a united European position without showing our hand. … I don’t think a unified European monetary system is in our interest.”

Because the dollar had become grossly overvalued relative to several other currencies, a group of ten developed countries (G10) met in Washington in December 1971 to negotiate exchange rate realignment. In what became known as the Smithsonian Agreement the dollar was devalued by 10.7% versus a basket of currencies (De Vries 1976 555). The official (“fictional”) gold price was raised to $38 as exchange rates were formally still expressed in parities vis-à-vis the official gold price.

Over a year later pressure on the dollar broke its peg again. In March 1973 the G10 accorded that 6 EEC currencies would jointly float against the dollar, effectively discontinuing what was left over from Bretton Woods. IMF members were free to choose any form of exchange arrangement, “except pegging their currency to gold.”

Among IMF members there was a desire to reform the monetary system, for which a novel reserve asset was developed: the Special Drawing Rights (SDR). In general, both the US and Europe supported the introduction of the SDR in 1969, albeit for different reasons. The Europeans wished the SDR could substitute the dollar (Zijlstra 1992 222), while the US concocted “the nations of the world come to accept Special Drawing Rights in lieu of gold.” All the while Bretton Woods crumbled, the SDR was used as a decoy by the United States.

A European Gold Pool

The US received intelligence that the Europeans were preparing to mobilize their gold by transacting bullion among themselves at the free market price. Then Secretary of the Treasury, George Shultz, wrote to President Nixon:

Some—but not all European officials— … see the proposed move as enhancing the probability that gold will work its way back into the center of the international monetary system and facilitate a French-European vision of a new monetary system.

We should actively support … amending existing agreements so that monetary authorities may sell gold into private markets at the market prices but may not buy gold from any source except at the established official price. It would be hoped that this procedure would permit a gradual phase-out in the official monetary use of gold.

Although the exact date from the above memo isn’t known, it’s likely from October 1973. At BIS headquarters, in November 1973, Zijlstra suggested rescinding the Washington agreement of March 1968. Chairman of the Fed, Arthur Burns, proposed to allow selling (not buying) by central banks in the private market (De Vries 1985 609). Burns’ offer was accepted and from that day central banks could sell gold, just as envisioned by Schultz.

Apparently, it was irrelevant where policy makers met (in Bazel or elsewhere), as long as they had a majority vote in the IMF a decision could be made. Although the US had broken the rules of the Articles of Agreement by ceasing to convert dollars in 1971, the Europeans were cautious to do the same.

Of course, the Europeans wanted more than being able to sell gold. In a Wikileaks cable from 1973 it reads the Minister of Finance of the Netherlands, Willem Duisenberg, told an American ambassador that all currencies should be convertible “or money has no meaning.” In other cables (here and here) from early 1974 it reads that France wanted to regulate (stabilize) the free market price of gold and the EEC oriented to use their gold for international settlement. The former being a prerequisite for the latter (Zijlstra 1981 10). If the EEC joint float would be pegged to gold it would result in “a new gold-based currency bloc.” Within the EEC the Germans weren’t enthusiastic about these ideas, because, as we shall see, they were still being played by the US.

Zijlstra made his views public on March 13, 1974, in a speech in Zurich, Switzerland (Zijlstra 1974):

Central banks holding gold should be free … to … buy and sell gold in the free market – perhaps regulating the price a little through a new-style gold pool – or … use it in settlements between one another. In this latter context one might think in particular of regional groupings like the EEC.

One month after, the Ministers of Finance of the EEC held a conference in Zeist, the Netherlands, that conceptually produced the same as Zijlstra’s views in Zurich (EEC 1975 19).

Monetary authorities should be permitted to buy and to sell gold among themselves at a market related price and to buy and sell on the free market (hold gold in the center of the monetary system).

Monetary authorities periodically fix a minimum and a maximum price beyond which they would not respectively sell or buy on the market (stabilizing the gold price).

Creating a buffer stock to be managed by an agent who would be charged by the monetary authorities to sell or buy on the market such as to ensure orderly conditions on the free market for gold (a new gold pool).

The Americans countered the EEC from the inside. First, on June 3, 1975, Burns wrote to a colleague (Alan Greenspan) that he has “a secret understanding in writing with the Bundesbank—concurred in by [Minister of Finance] Mr. Schmidt—that Germany will not buy gold, either from the market or from another government, at a price above the official price,” which pretty much blocked the Zeist initiative. Without Germany the EEC wasn’t able to form a gold pool, stabilize the price and use gold for international settlement.

Burns’ secretive understanding can be traced to a letter dated November 14, 1973, by then Bundesbank President, Karl Klasen, to the Fed pledging adherence, with Schmidt’s consent, to Article IV Section 2 about not trading gold at a price other than the official par value.

Second, ample leverage equipped the US to go the extra mile. Advisors of US President Ford wrote on June 4, 1975, on the role of gold in the international monetary system: “We must first swing Germany, thus isolating France.” On June 6 President Ford felt comfortable to tell Minister Schmidt:

We … do feel strongly that some safeguards are necessary to ensure that a tendency does not develop to place gold back in the center of the system. We must ensure that there is no opportunity for governments to begin active trading in gold among themselves with the purpose of creating a gold bloc or reinstating reliance on gold as the principal international monetary medium.

Most definitely the Germans obeyed and threw a wrench in the Zeist initiative, as it was strangely never realized.

By not converting dollars into gold when the Fed’s gold window was still open, Germany dug itself into a hole. Next to being dependent on US troops, Germany’s gold to total reserves ratio was so much lower than in surrounding countries that any revaluation of monetary metal relative to dollars would have been sorely embarrassing (chart 6).

Aside from the US the least developed countries (LDCs) of the world also opposed the activation of official gold holdings, for the simple reason they owned fairly little.

The IMF began selling 750 tonnes of gold from its own stock to use for concessional loans to LDCs in 1976 (De Vries 1985 662). At the announcement of the sale the gold price in the free market declined. Ironically, the Swiss central bank (SNB) considered buying some of the gold at auction “to demonstrate its attachment to gold and participate in efforts to stabilize the gold price,” SNB reminisces in its centenary. Four years later in 1979, when the gold price skyrocketed, SNB “considered selling gold on the market, in a coordinated action with other central banks, with the aim of stabilizing the price.”

By 1978 the IMF’s Articles of Agreement had been amended and central banks could buy and sell gold in the private market (De Vries 1985 656). The idea to put monetary gold to use hadn’t died in Europe and so in 1979 the idea to intervene floated again. This time also for gold not to make a mockery out of their fiat currencies and calm monetary unrest.

Before me, attempts of forming a European gold pool in 1979 have been covered by precious metals analyst Ronan Manly (here and here). Manly was able to get his hands on documents from the Bank of England (BOE) in which a new gold pool was discussed. What stands out from Manly’s publications, in relation to our present analysis, is that France didn’t want to participate because Germany resisted and the pool never saw the light of day.

The following quotes are from multiple BOE documents regarding meetings at the BIS in 1979. Paul Jeanty was a dealer in the London Bullion Market, all the others government officials. In brackets it’s clarified who is representing which country:

Paul Jeanty told me [McMahon, UK] that Zijlstra had told him personally a couple of weeks ago that he would now be in favor of a central bank operation to stabilize the price within a moving band. Leutwiler [Switzerland] and Clappier [France] have said this to him in the past and he believes … that de Stryker [Belgium] and Baffi [Italy] would go along with such a plan. All recognize, however, that Emminger [Germany] has no disposition to support.

Fritz [Switzerland] had told Jeanty, what Jeanty already knew, that Zijlstra would be interested; however, apparently Clappier indicated that he was against. This was a reversal of view which Leutwiler attributed to pressure from the Élysée [France] which was itself influenced by the Germans. … Emminger continued to be strongly against.

Leutwiler and Zijlstra then said that although they did not think a very large group was necessary to undertake the operation it probably had to be bigger than two: specifically, they really needed either the French or the Germans.

The core of Europe tried to form a gold pool, but Germany was jamming the project again! Very likely the Germans were still on a leash of the United States.

The US Oil Deal with Saudi Arabia

Suppressing the role of gold was one part in the bigger picture of the US to install the dollar hegemony. In part two “risk free” dollar assets were required to become the prime international reserves.

The oil crisis in the early 1970s was a blessing and a curse for the US. It caused expenses to go up, but a higher price of oil also created more demand for dollars abroad. Now those dollars needed to be invested in US governments bonds (Treasuries).

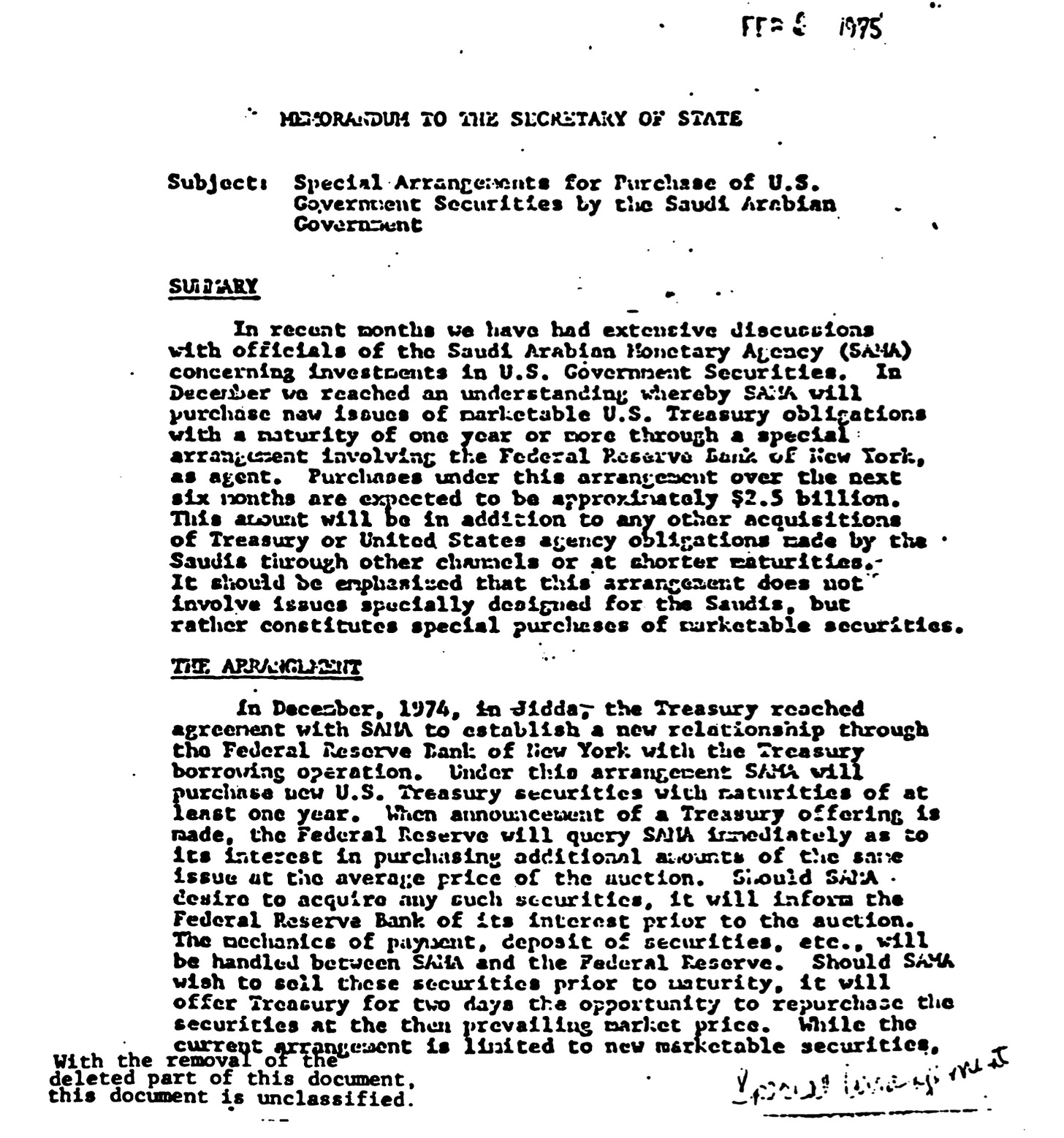

In July 1974, Secretary of the Treasury, William Simon, visited the Middle-East to dust off a proposal by Saudi Arabian Oil Minister, Yamani, from 1970. Simon’s endeavor was for the Saudis to recycle dollars in bonds.

Eventually the deal encompassed Saudi Arabia to supply oil to the United States and invest the proceeds in Treasury securities. In return, the US would provide military aid and hand the kingdom an “add-on” in the form of a special treatment in Treasury auctions. On request of Saudi King Faisal the deal would remain “strictly secret.”

The add-on allowed the Saudi Arabian Monetary Agency (SAMA) non-competitive bidding outside of the normal auctions held by the New York Fed and avoid disrupting the market caused by large security purchases on their part. “The sine-qua-non for the Saudis in this arrangement is confidential and we have assured them that we will do everything in our power to comply with their desires,” Undersecretary of the Treasury for Monetary Affairs, Jack Benett, writes in a memo to Kissinger in 1975.

For starters $2.5 billion was expected to be invested by SAMA, but shortly after the Treasury inadvertently raised $800 million more than it intended to borrow at auction. Dollars were recycled alright.

Conclusion

It wasn’t all smooth sailing for the dollar in the 1970s, but the US managed to secure its currency as the sun in the international monetary cosmos. In his memoirs, Zijlstra looks back on how it happened (1992 211):

Gold disappeared as the anchor of monetary stability. An attempt to replace it with a newly created substitute (the IMF's [SDR] …) virtually failed. The fixed parities, apart from our own EEC system, have disappeared. … The road from dollar supremacy, through endless vicissitudes, to a new dollar hegemony was paved with many conferences, with faithful, shrewd, and sometimes misleading stories, with idealistic visions of the future and impressive professorial speeches. (For every notion, no matter how extreme, there is always a professor of economics available.) The political reality was that Americans supported or fought any change, depending on whether they saw the dollar's position strengthened or threatened.

According to Zijlstra and De Gaulle, final settlement in cross-border trade should be done in gold and the use of reserve currencies restricted (Zijlstra 1972). What frightened the US was that Europe held the most gold and alluded to raising the gold price periodically to create liquidity, giving them “the dominant means of creating reserves.” A few days after the Zeist conference an advisor of Kissinger explained it to him well:

Mr. Enders: It’s against our interest to have gold in the system because for it to remain there it would result in it being evaluated periodically. Although we have still some substantial gold holdings … a larger part of the official gold in the world is concentrated in Western Europe. This gives them the dominant position in world reserves and the dominant means of creating reserves. We’ve been trying to get away from that into a system in which we can control—

Secretary Kissinger: But that’s a balance of payments problem.

Mr. Enders: Yes, but it’s a question of who has the most leverage internationally. If they have the reserve-creating instrument, by having the largest amount of gold and the ability to change its price periodically, they have a position relative to ours of considerable power.

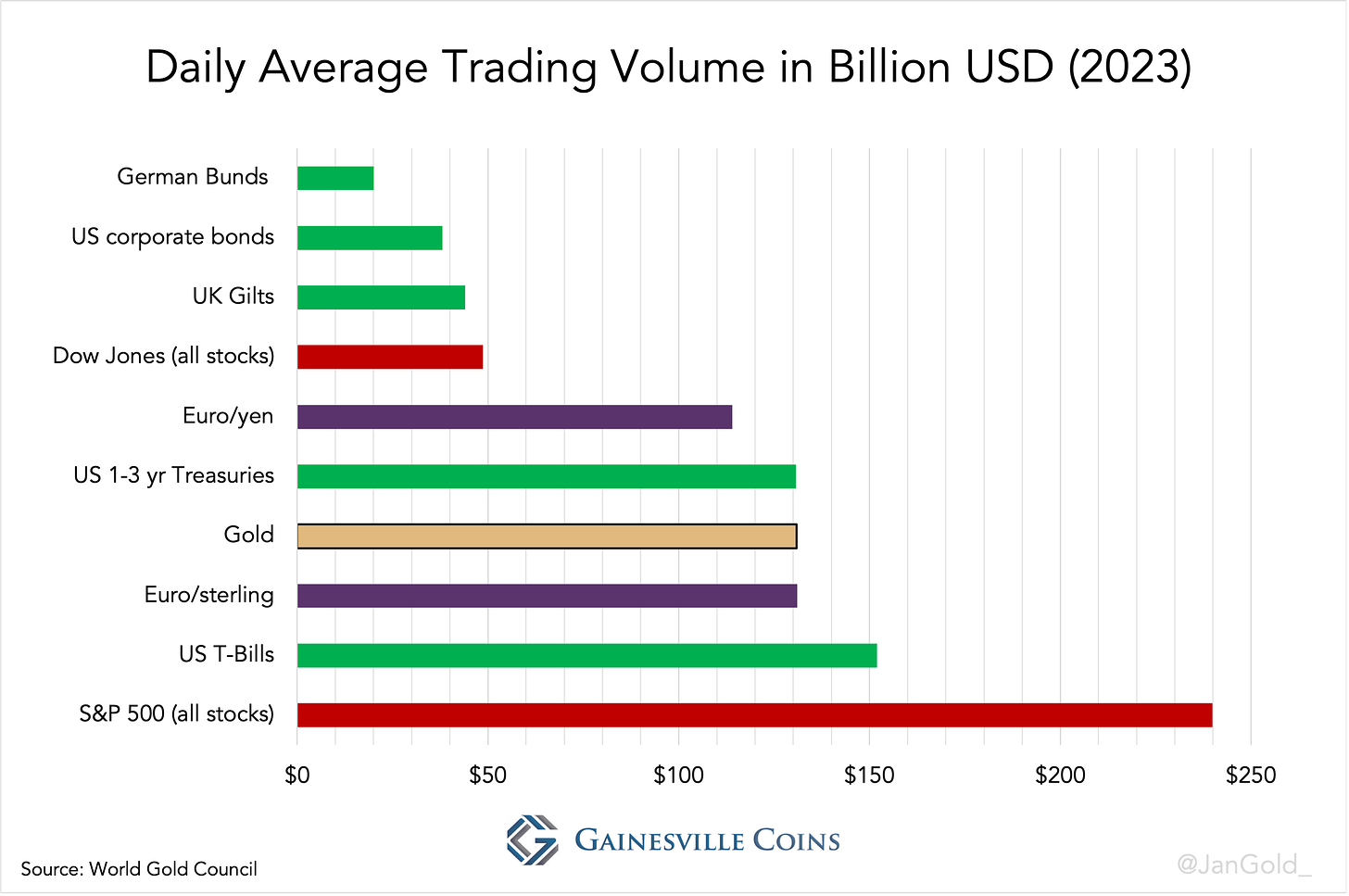

Remarkably, everything that held back the envisioned monetary system of Zijlstra and friends in the 1970s has been resolved. Since Germany repatriated gold from New York several years ago we may assume it has released itself from bondage. Gold is globally more evenly distributed (chart 5), there is a gold leasing market for those that are looking for a yield, and the gold market is liquid. The fact the Dutch central bank recently signaled that it has prepared for a new gold standard makes perfect sense from a historical perspective.

Experience from Bretton Woods and the need to periodically increase the gold price suggests that Europe would target the price in the free market in order to stabilize it. The remaining questions are, (i) what could trigger Europe to stabilize the gold price in the future, and (ii) at what price level?

Sources:

Avaro, Maylis. “A Gold Battle? De Gaulle and the Dollar Hegemony during the Bretton Woods era.” (2022)

Bloomberg. “The Untold Story Behind Saudi Arabia’s 41-Year U.S. Debt Secret.” (2016)

Bordo, Michael, Eric Monnet, and Alain Naef. “The Gold Pool (1961–1968) and the Fall of the Bretton Woods System. Lessons for Central Bank Cooperation.” (2017)

Bordo, Michael. “The Bretton Woods International Monetary System: A Historical Overview.” (1993)

Bordo, Michael, Dominique Simard, and Eugene Nelson White. “France and the Breakdown of the Bretton Woods International Monetary System.” (1994)

Bordo, Michael. “The operation and demise of the Bretton Woods system: 1958 to 1971.” (2017)

Bundesbank. “1973: The end of Bretton Woods When exchange rates learned to float.” (2013)

Bundesbank. “From our archive: The Blessing letter.”

Bundesbank. “Germany’s Gold.” (2018)

Burns, Arthur. “Memorandum For Alan Greenspan.” (1975)

Dibooglu, Selahattin. “Inflation under the Bretton Woods System: The Spillover Effects of U.S. Expansionary Policies.” (1999)

Emminger, Otmar. “The D-Mark in the Conflict Between Internal and External Equilibrium, 1948–75.” (1977)

European Economic Community. “Official Journal of the European Communities.” (1975)

Federal Response to OPEC Country Investments in the United States (Part 1 – Overview). (1981)

Federal Reserve Bank of Dallas. “Annual Statement 1968.” (1968)

Federal Reserve Bank of St. Louis. “The United States Balance of Payments 1946–1960.” (1961)

Federal Reserve History. “Creation of the Bretton Woods System.” (2013)

Federal Reserve History. “The Smithsonian Agreement.” (2013)

Gold Pool. “Washington Communique.” (1968)

Graetz, Michael, and Olivia Briffault. “A "Barbarous Relic": The French, Gold, and the Demise of Bretton Woods.” (2016)

International Monetary Fund. “Articles of Agreement.” (Various years)

International Monetary Fund. “The end of the Bretton Woods System (1972–81).”

Lederer, Walter. “The Balance on Foreign Transactions: Problems of Definition and Measurement.” (1963)

Manly, Ronan. “New Gold Pool at the BIS Basel, Switzerland: Part 1.” (2017)

Manly, Ronan. “New Gold Pool at the BIS Basel: Part 2.” (2017)

Mundell, Robert. “World Inflation and the Eurodollar.” (1971)

Naef, Alain. “An Exchange Rate History of the United Kingdom, 1945–92.” (2022)

New York Times. “Germany Raises Mark By 3%, Joins France in Float.” (1973)

Nieuwenhuijs, Jan. “German Central Bank: Gold Is the Bedrock of Stability for the International Monetary System.” (2019)

Nieuwenhuijs, Jan. “Europe Has Been Preparing a Global Gold Standard Since the 1970s.” (2020)

Nieuwenhuijs, Jan. “What Happened to the $650 Billion in SDRs Issued in 2021?.” (2022)

Nieuwenhuijs, Jan. “Europe Has Been Preparing a Global Gold Standard Since the 1970s. Part 2.” (2022)

Nieuwenhuijs, Jan. “Dutch Central Bank Admits It Has Prepared for a New Gold Standard.” (2023)

Grabbe, James Orlin. “The Gold Market.” (1998)

Green, Timothy. “The World of Gold Today.” (1973)

Green, Timothy. “The New World of Gold.” (1982)

Kissinger, Henry, William Simon. “Telcom.” (1973)

Pollack, Gerald, William Moore, Thomas Boggs, Alan Murray, and Donald Webster. “The United States Balance of Payments—Perspectives and Policies.” (1963)

Der Spiegel. “Der Brief Gilt Leider Noch Heute.” (1971)

Spiro, David. “The Hidden Hand of American Hegemony: Petrodollar Recycling and International Markets. (1999)

Swiss National Bank. “The Swiss National Bank 1907–2007.” (2007)

Trachtenberg, Marc. “The French Factor in U.S. Foreign Policy during the Nixon-Pompidou Period, 1969–1974.” (2010)

de Vries, Margaret Garritsen. “The International Monetary Fund 1966–1971. Volume I: Narrative.” (1976)

de Vries, Margaret Garritsen. “The International Monetary Fund 1972–1978. Volume II Narrative and Analysis.” (1985)

Wikileaks. “AMBASSADOR'S CALL ON DUTCH FINANCE MINISTER.” (1973)

Wikileaks. “EC MONETARY COMMITTEE MARCH 8 DISCUSSION ON GOLD.” (1974)

Wikileaks. “EC COMETARY COMMITTEE MEETING MARCH 8-- GOLD AND RECYCLING.” (1974)

Wikileaks. “KING FAISAL'S VIEWS OF PURCHASE OF TREASURY INSTRUMENTS.” (1974)

Wittich, Günter, and Masaki Shiratori. “The Snake in the Tunnel.” (1973)

Zijlstra, Jelle. “Reflections on international economic and monetary problems.” (1974)

Zijlstra, Jelle. “Dr. Jelle Zijlstra.” (1978)

Zijlstra, Jelle. “Central Banking with the Benefit of Hindsight.” (1981)

Zijlstra, Jelle. “Per slot van rekening.” (1992)

Sources from the US Office of the Historian:

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME III, FOREIGN ECONOMIC POLICY; INTERNATIONAL MONETARY POLICY, 1969–1972. 111. Volcker Group Paper. (1969)

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME III, FOREIGN ECONOMIC POLICY; INTERNATIONAL MONETARY POLICY, 1969–1972. 131. Action Memorandum From the President’s Assistant for National Security Affairs (Kissinger) to President Nixon. (1969)

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME III, FOREIGN ECONOMIC POLICY; INTERNATIONAL MONETARY POLICY, 1969–1972. 153. Paper Prepared in the Department of the Treasury. (1971)

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME XXIV, MIDDLE EAST REGION AND ARABIAN PENINSULA, 1969–1972; JORDAN, SEPTEMBER 1970. 168. Memorandum From the President’s Assistant for International Economic Affairs (Flanigan) and the President’s Assistant for National Security Affairs (Kissinger) to President Nixon.

MILESTONES: 1969–1976. Nixon and the End of the Bretton Woods System, 1971–1973.

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME XXXI, FOREIGN ECONOMIC POLICY, 1973–1976. 16. Conversation Among President Nixon, the Chairman of the Federal Reserve System Board of Governors (Burns), the Director of the Office of Management and Budget (Ash), the Chairman of the Council of Economic Advisers (Stein), Secretary of the Treasury Shultz, and the Under Secretary of the Treasury for Monetary Affairs (Volcker). (1973)

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME XXXI, FOREIGN ECONOMIC POLICY, 1973–1976. 54. Memorandum From Secretary of the Treasury Shultz to President Nixon.

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME XXXI, FOREIGN ECONOMIC POLICY, 1973–1976. 56. Editorial Note.

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME XXXI, FOREIGN ECONOMIC POLICY, 1973–1976. 63. Minutes of Secretary of State Kissinger’s Principals and Regionals Staff Meeting. (1974)

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME XXXI, FOREIGN ECONOMIC POLICY, 1973–1976. 86. Memorandum From the Chairman of the Federal Reserve System Board of Governors (Burns) to President Ford. (1975)

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME XXXI, FOREIGN ECONOMIC POLICY, 1973–1976. 88. Memorandum From the Assistant Secretary of State for Economic and Business Affairs (Enders) to the President’s Assistant for Economic Affairs (Seidman). (1975)

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME XXXI, FOREIGN ECONOMIC POLICY, 1973–1976. 89. Letter From President Ford to West German Chancellor Schmidt. (1975)

FOREIGN RELATIONS OF THE UNITED STATES, 1969–1976, VOLUME XXXI, FOREIGN ECONOMIC POLICY, 1973–1976. 129. Briefing Memorandum From the Assistant Secretary of State for Economic and Business Affairs (Enders) to Secretary of State Kissinger. (1976)

Thank you, Jan. Your articles get ever better, and this is one of the best. Much appreciated.

This is probably the most comprehensive and informative article I have read on the real politics underlying post-war international monetary policy. It deserves a wide circulation.