Written by Jan Nieuwenhuijs, originally published at Gainesville Coins.

Some gold commentators are writing the central bank of Russia has linked the ruble to gold, but this is not true.

In the fog of war the first causality is the truth, and this time it’s no different. Information coming from either side of the war between Russia and Ukraine about military, political, or financial developments should be treated with skepticism.

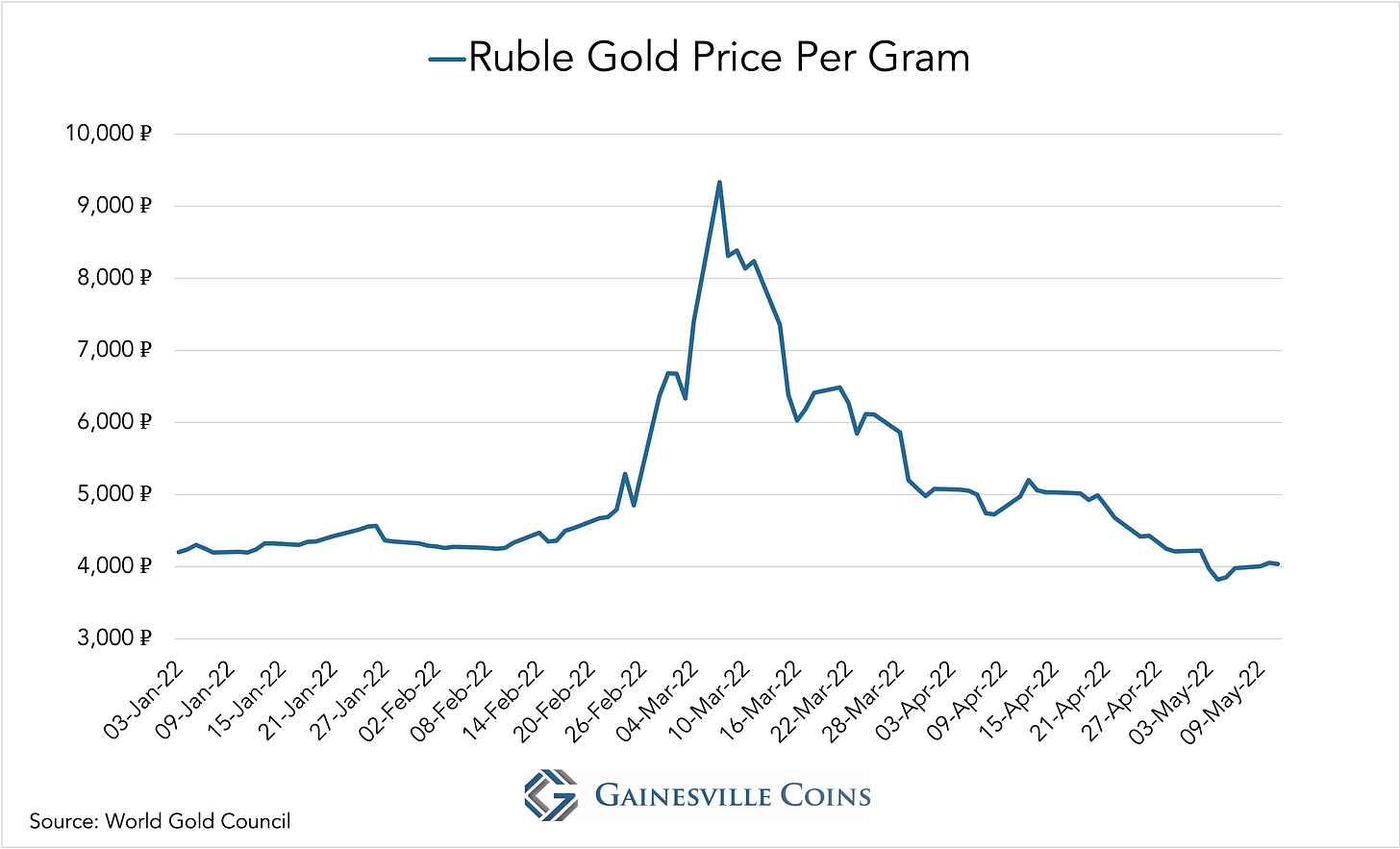

On March 28, 2022, the central bank of Russia (CBR) announced it would buy gold from Russian credit institutions (banks) at a fixed price of 5,000 rubles per gram. At the time the prevailing price in the free market was 6,000 rubles per gram. As CBR’s bid price was lower than the free market price it made no sense for banks to sell to CBR.

After an initial steep devaluation of the ruble when the war started on February 21, 2022, it reversed course in early March. In my view this was because at Gazprombank, one of the few Russian financial institutions not sanctioned, incoming euro payments for gas are exchanged into rubles. Whatever the reason, the appreciating ruble (RUB) caused the price of currencies and commodities, including gold, denominated in rubles to decline. As a result, on April 7 the gold price hit 5,000 RUB/gram.

For a moment it looked like the ruble gold price was stabilizing—as if CBR was buying up gold and holding the price at 5,000 RUB/gram. But then CBR announced they would suspend buying gold at a fixed price. From the press service of CBR:

Due to a significant change in market conditions, the Bank of Russia is making adjustments to its pricing policy when carrying out operations to purchase gold from credit institutions. From April 8, 2022, the purchase of gold by the Bank of Russia will be carried out at a negotiated price.

The link was severed from the get-go.

Several gold analysts, however, still report the ruble is linked to gold, suggesting the Russians have gone on a semi-gold standard. On May 3 gold commentator Jim Rickards wrote:

Russia has just linked the ruble to gold at a rate of 5,000 rubles to one gram of gold.

This is false. I know because CBR disclosed this on their website, but also because as the ruble keeps strengthening, the ruble gold price keeps falling. At the time of writing the gold price is around 4,000 RUB/gram. How’s that possible if CBR is pegging gold at 5,000 RUB/gram? Obviously, CBR has not “linked the ruble to gold at a rate of 5,000 rubles to one gram of gold.”

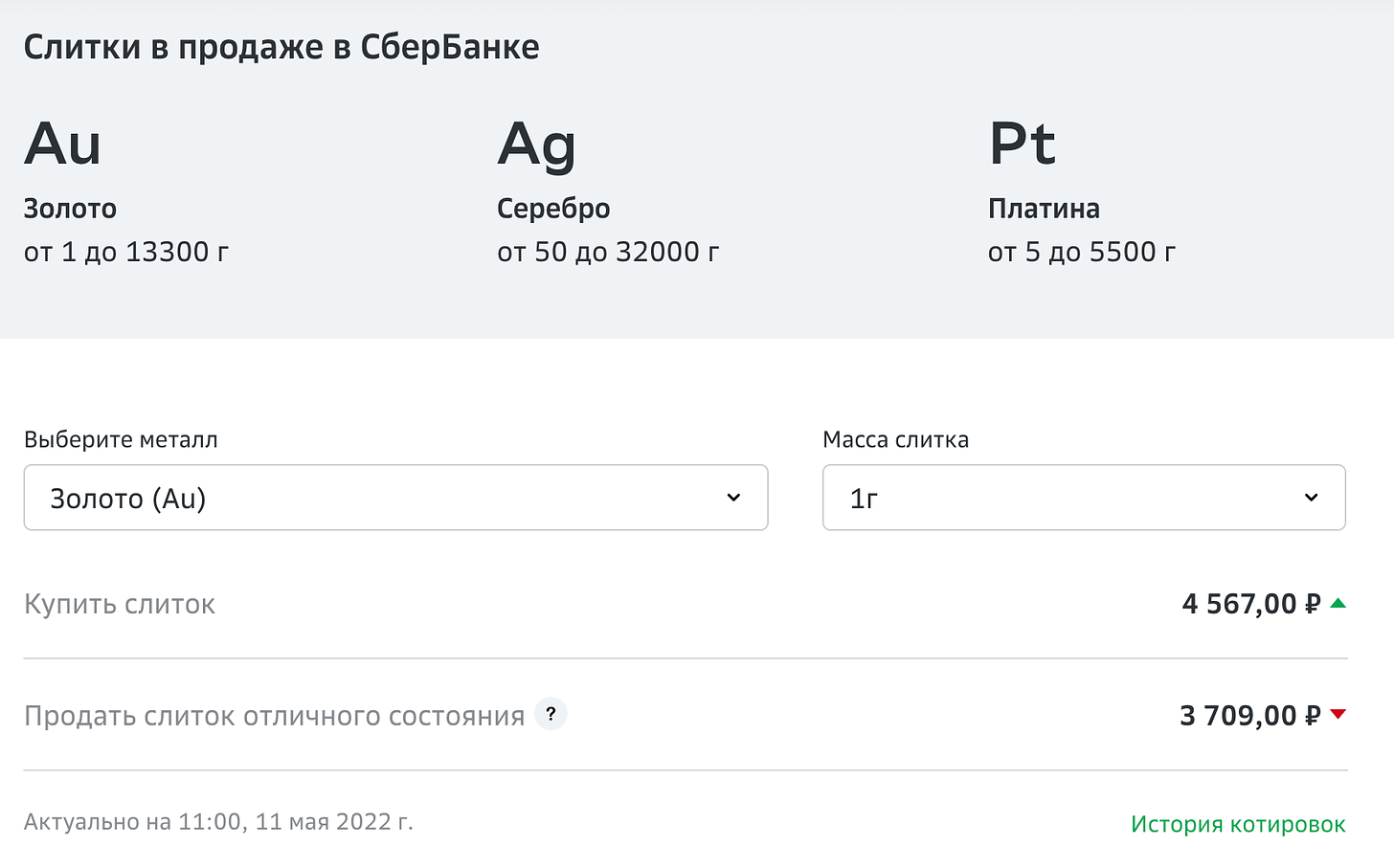

If you don’t believe the gold price in the chart above because it could be calculated by the World Gold Council based on an inaccurate foreign exchange rate of the ruble, have a look below at prices of Russian gold dealer Sberbank. On May 11 clients could buy gold at 4,567 RUB/gram and sell at 3,709 RUB/gram. The mid-market price was 4,138 RUB/gram: in line with prices from the World Gold Council.

Does that mean Russia will not return to a gold standard? Not now they won't. There was a statement coming from the Kremlin about backing the ruble with gold and commodities on April 26 but it was refuted by the CBR three days later. I suggest we wait for strong evidence before concluding a link between the ruble and gold.

As I have written about extensively I do think the world is heading towards some form of a gold standard. Interestingly, Credit Suisse’s Global Head of Short-Term Interest Rate Strategy, Zoltan Pozsar, has been writing something similar since the outbreak of the war. Pozsar describes the ascent of a new international monetary order in which gold’s role will increase substantially. In a forthcoming article we will zoom in on Pozsar’s analysis and the future of gold.

I have stopped reading anything that Rickards postulates.

Are the Russian financial institutions just a "pass-through" for buyers of Russian oil? Russia has said she wants rubles for oil. But there is not much of a market for rubles vs other currencies. So (example) Indian refiner brings gold to Sberbank, who buys the gold at 5000 rubles / gram, Indian refinery gets rubles to buy oil. It's true Indian refiner is getting screwed on the gold price, but if the price of oil is discounted enough, it could be worthwhile. Am I thinking straight?