Written by Jan Nieuwenhuijs, originally published at Gainesville Coins.

To gain a comprehensive understanding of the mechanics of the gold wholesale market, it's essential to be familiar with its key building blocks: swaps, leases, and forwards. In this article, we will explore these components and their interactions to be better equipped to evaluate developments in the gold market.

If you are new to gold investing or have a general interest in financial markets, you may frequently encounter blog posts, articles, or literature mentioning the gold forward curve, swap rate, or other terms that can initially be confusing. We will start discussing the gold lease market and then forwards and swaps to clarify what it all means.

The Gold Lease Market

Gold leasing is basically the same as gold lending. In the gold wholesale market physical gold can be lent and borrowed, usually via a bullion bank. A central bank, for example, might lend gold to a bullion bank and a jewelry manufacturer might borrow this metal from the bullion bank. The interest rate of gold is called the gold lease rate. Interest can be settled in gold or currency in the over-the-counter (OTC) London Bullion Market, which is still the largest gold market globally.

A bullion bank market maker will quote bids (to borrow gold) and offers (to lend gold) for 1, 3, 6, and 12 months out to its clients. Although, any trade in the OTC market can be tailored to the needs of the customer. The spread between a market maker’s bid and corresponding offer, which depends on market volatility and transaction size, is its profit.

Any loan attracting an interest, including a gold loan, has grown more valuable at maturity. If a central bank lends out 1,000 ounces for 6 months (180 days) at an interest rate of 2%, it receives 1,010 ounces (more value) from the borrower when the loan comes due. Assuming interest was agreed to be paid in gold. The formula is:

1000*(1+((180/360)*2/100)) = 1,010 ounces

Wherein “1000” are the ounces of gold, “180/360” is the time frame (commonly interest rates in financial markets are calculated on a 360 days a year basis), and “2” is the interest rate.

In the same spirit, a $2,000,000 dollar loan for a tenor of 6 months grows into $2,070,000 at an interest rate of 7%.

2000000*(1+((180/360)*7/100)) = $2,070,000 dollars

The Gold Forward Market

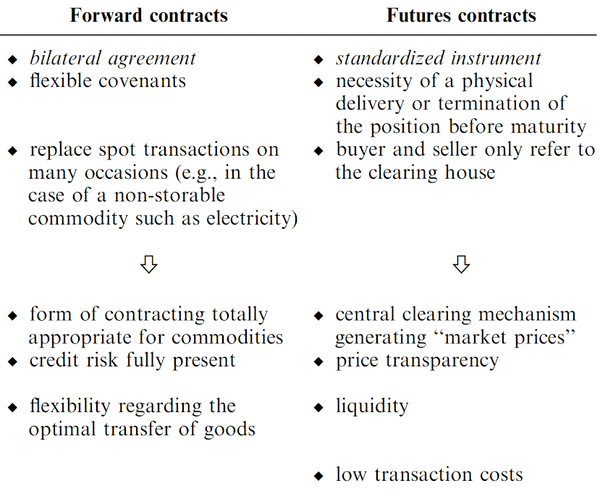

Next to leasing, gold industry participants can sign a contract with a bullion bank, either to speculate or for hedging purposes, to buy or sell gold at a pre-determined date in the future for a fixed price. Such an agreement brokered in the OTC market is called a forward contract, not to be confused with a futures contract traded on exchanges.

Suppose the spot gold price is $2,000 per fine troy ounce. A bullion bank quotes a bid to its clients to buy 1,000 ounces forward 6 months out for $2,050. A mining company hits the bid to lock in the price of its future production. A forward contract is signed by the bank and the miner for the future exchange of currency for metal 6 months from now.

The forward rate expresses how much more expensive (or cheaper) gold is traded for future exchange. In our example, the 6-months forward rate is 5%.

((2050–2000)/2000*100)/(180/360) = 5%

To digress, a 6 months forward price of $2,050 does not mean the spot gold price in 6 months’ time will be $2,050. The spot gold price is determined by supply and demand of physical metal in each moment.

Free markets that cater facilities for lending currencies, spot exchange and trading in forward contracts give rise to interest rate parity. The theory of interest rate parity suggests that the interest rates of two currencies determine the forward price of each currency denominated in the other. Put differently, the gold lease rate, the dollar interest rate and the forward dollar gold price are related to each other. Arbitrage is what binds all three together.

Imagine, in our example, the forward gold price 6 months out moving lower, from $2,050 to $2,040 (we will ignore bid-offer spreads). An arbitrager will buy (long) this “cheap” forward gold at $2,040 dollars an ounce. Spot–forward arbitrage requires the opposite trade in the spot market—or one just enters into a forward contract—in this case sell (short) spot gold.

To finance his trade, the arbitrager borrows gold. He then sells the gold in the spot market for dollars, lends out those dollars for 6 months, and signs a forward to buy the gold he needs to repay his gold loan in the future. Six months later he receives dollars, settles the forward contract, and repays the gold loan. The arbitrager can do this, creating more demand for forward gold, until the forward price is back at $2,050. Let’s have a closer look at the math.

In the present the arbitrager will borrow 1,000 ounces of gold for 6 months at 2%. In time he is required to pay back 1,010 ounces. The 1,000 ounces are sold at a spot price of $2,000, the proceeds of which are $2,000,000 dollars to be lent out for 6 months at 7%. A forward contract is signed with a bullion bank to buy 1,010 ounces in 6 months’ time at $2,040 per ounce, at a value of (1010*2040) $2,060,400 dollars. Fast forward 6 months, and the arbitrager is returned the dollars plus interest, equal to (2000000*1.035) $2,070,000, leaving a profit of (2070000-2060400) $9,600 dollars.

When the forward price would transcend $2,050 arbitragers do the opposite, that is buy spot gold and sell it forward. Arbitragers can choose to maximize their profit by lending out the gold until the forward expires or store the gold and pay storage fees. It is the gold lease rate, though, that sets the lower bound of the forward price.

Kindly note that the closing of an arbitrage opportunity in the forward price happens in the present, while the profits are collected in the future.

Also note that the converging of markets works moderately different from what I have just described, because all variables, not only the forward price but also the gold lease and dollar rate, can give way by arbitragers trading in multiple markets until interest rate parity has manifested. Interest rate parity implies the spot, lending and forward markets are strongly linked. If one segment of the market is moving the others will move accordingly.

Needless to say, in reality traders are also confronted with costs for shipping, insurance, transaction fees, etc.

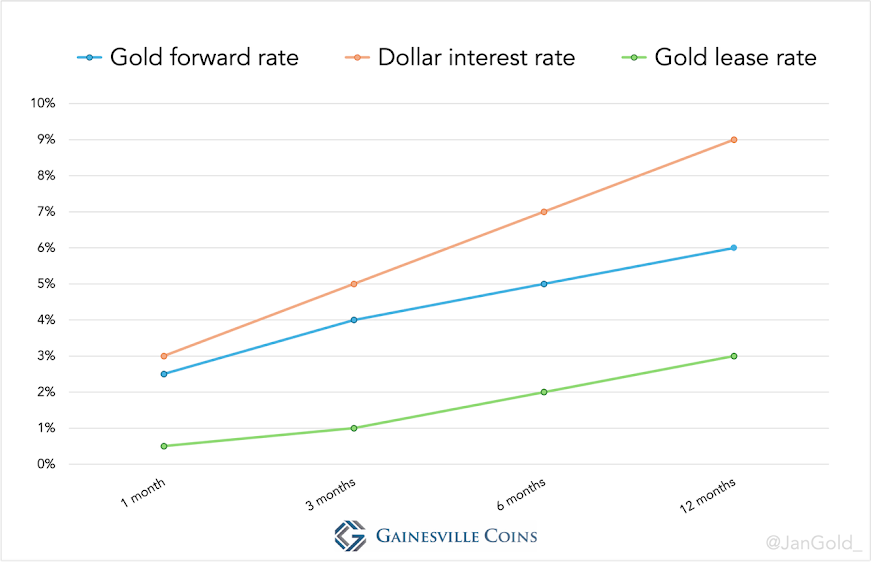

Based on the relationships between interest rates and forward prices (and thus the forward rate) we have the basic formula1:

Forward rate = dollar interest rate – gold lease rate

In our example:

5% = 7% – 2%

In theory, if any of the rates do not comply with the formula, arbitragers will step in.

The formula can be rewritten as:

Gold lease rate = dollar interest rate – forward rate

Dollar interest rate = forward rate + gold lease rate

The Gold Swap Market

So far, we have merely looked at unsecured lending. We saw that a borrower pays the gold lease rate that the lender demands to be compensated for the risk of default and postponement of using the metal. However, a gold loan can also be collateralized with dollars (as well as alternative currencies and assets). Collateralized gold lending, which is the definition of a swap, enjoys a lower interest rate due to less credit risk. In other markets a swap is called a carry trade or repo (repurchase agreement).

A swap refers to “lending” because there is a spot exchange of gold for currency, with both parties agreeing to reverse the transaction at a predetermined date in the future for a fixed price. The contract involves a spot and forward exchange, which is why it's termed collateralized (or “secured”) lending.

In the conventions of the precious metals markets, the word “swap,” unless otherwise qualified, refers to a buy metal spot/sell metal forward transaction from the borrower’s perspective. From the lender’s perspective, it is a sell metal spot/buy metal forward deal.

From: A Guide to the London Precious Metals Markets.

An example: a central bank wants to borrow $2,000,000 for 6 months but thinks the dollar interest rate is too high. Bullion banks offer a discount if the central bank pledges 1,000 ounces of gold to secure the dollar loan. For a bullion bank, in case the central bank can’t repay the dollar loan, it will keep the gold as compensation for its dollar loss. Now for the calculation of the swap rate.

The gold from the central bank—worth $2,000 per ounce in the spot market—is received by the bullion bank as collateral. At the same time the bullion bank transfers $2,000,000 to the central bank. The bullion bank lends out the gold to a third party for 6 months at 2%, allowing the central bank to get a 2% discount on the $2,000,000 dollar loan of 7%. Effectively, the central bank pays a swap (“lending”) rate of 5%, which, as you might have noticed, is the equivalent of the gold forward rate. After 6 months the central bank transfers the principal plus interest, (2000000*1.025) $2,050,000, to the bullion bank and gets back its 1,000 ounces of gold.

The fact the bullion bank earned (1000*0.01*2000) $20,000 on the gold loan is what made it discount the dollar loan by the same amount2. At a dollar interest rate of 7% the central bank would have paid $70,000 in interest, but at a swap rate of 5% the central bank paid $50,000 in interest, the difference being $20,000.

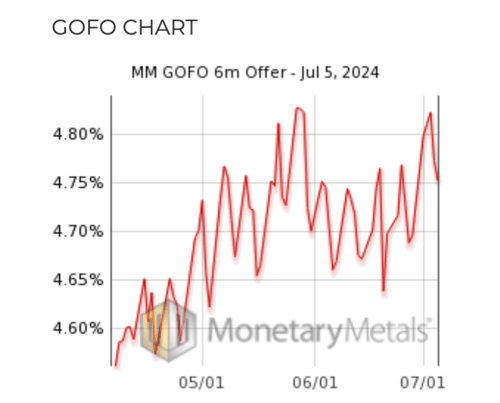

Swap rate = forward rate = dollar interest rate – gold lease rate

GOFO (Gold Offered Forward Rate) is the benchmark swap rate in the OTC market at which bullion banks “lend gold on swap against US dollars3.” Until 2015 the London Bullion Market Association (LBMA) published GOFO rates on its website. Currently, people can use publicly available gold forward (or futures) rates to guesstimate the OTC swap (GOFO) and gold lease rate.

Gold lease rate = dollar interest rate – GOFO

Regardless of the above, swaps are negotiated on varying terms. Sometimes the gold pledged by a central bank isn’t within the LBMA’s chain of integrity (making the quality of the metal less trustworthy), which gives the bullion bank a reason to have a central bank overcollateralize the swap. Or a bullion bank assesses increased credit risk. And so on.

Conclusion

Understanding the main building blocks of the gold wholesale market makes the rest of the market more apprehensible. Once you know how swaps work it’s a small step to come to grips with other operations by bullion banks.

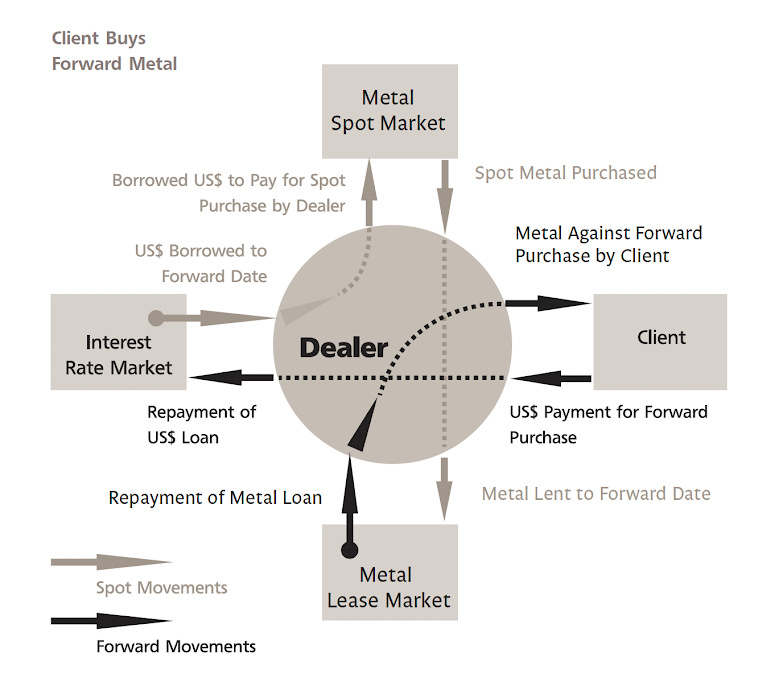

Take a dealer (bullion bank) that quotes its clients a 12-month forward offer (dealer sell, client buy) of $2,100 dollars per ounce. When a client hits that offer but the dealer can’t buy the same amount of gold 12 months forward from another client, which is quite likely, it needs to hedge itself. After all, if the gold price in 12 months’ time has risen and the dealer needs to buy spot at, for example, $2,300 to settle the forward at $2,100, that is a loss of $200 per ounce.

To hedge itself the dealer will borrow dollars, use the dollars to buy gold in the spot market, and lends out the gold for 12 months. Twelve months later the dealer gets the gold back and can deliver on its forward obligation to its client. In the forward leg the dealer sells gold, the proceeds of which he uses to repay the dollar loan.

As you can see forward hedging works similar to a swap4, which is why the forward and swap rate are equal. Only when one fully comprehends what the forward curve actually represents, it's possible to draw conclusions from its shape (contango or backwardation) with respect to the direction of the gold price. Which is what we will discuss in a forthcoming article.

Appendix

Strictly speaking, the formula is an approximation.

If the bullion bank agreed to settle the gold interest payment in currency, it would have received $20,000 dollars based on the formula:

1000*(2*(180/360)/100)*2000 = $20,000 dollars

Wherein “1000” are the ounces of gold, “2” is the gold lease rate, “(180/360)” is the time frame, and “2000” is the spot price.A bullion bank’s swap bid for him is to lend gold on swap against dollars (sell spot, buy forward), his offer is to borrow gold on swap against dollars (buy spot, sell forward).

Be aware that a swap can also be referred to as a swap forward, gold forward, or even just forward.

Sources

Geman, H, (2005): Commodities and Commodity Derivatives

Grabbe, J. O. (1998): The Gold Market

Jansen, K. (2016): GOFO and the Gold Wholesale Market

LBMA (2008): A Guide to the London Precious Metals Markets

LBMA (2017): The Guide. An Introduction to the Global Precious Metals OTC Market

Nieuwenhuijs, J. (2023): COMEX Gold Futures Explained Part 1: The Basics

Spall, J. (2010): How to Profit in Gold

Dumb question here: why would someone want to borrow gold ? Is it because they have an agreement to settle some kind of trade in gold instead of in fiat ? Maybe some drones for example (just saying :))

Dumb question 2: do central banks lend gold simply to earn interest?

Prompted to ask because the RBA down under was asked why it’s gold I s stored in London and not Australia and they simply said it would cost too much to bring it home AND that it’s easier to lend. The first argument to my mind specious and possibly the second too.

Do you know the minimum amount required to participate in the gold lease market (lend out gold), or the swap market? Is this activity open at all to normal people / businesses, or reserved for central banks? Thanks