Why Gold Coin Demand Doesn't Drive the Gold Price

Written by Jan Nieuwenhuijs, originally published at Gainesville Coins.

Demand for newly fabricated coins makes up only a small part of total trading volume in gold, and therefore has little impact on the gold price.

As we discussed in a previous article about the supply and demand dynamics of gold, the price of gold isn’t set between what is annually produced versus “consumed.” Because gold isn’t used up and there are vast above ground stocks (most of which is gold held for monetary purposes), the gold price is mainly determined by trade in above ground metal.

Gold trades as a currency. Demand for coins is just a small segment of total physical trading volume, and therefore doesn’t have a significant impact on the price.

Gold Prices Aren't Affected By Gold Coin Sales

Gold investors often wonder why the gold price doesn’t rise when premiums on coins are skyrocketing. The explanation is that these premiums arise from coin supply chain congestions, not from a shortage of gold itself.

Every gold product—an ornament, ring, bar, coin, etc.—needs to be manufactured. The manufacturing costs for, i.e., bars are fixed, but relatively lower for bars with a higher weight and value. A fixed manufacturing cost of $60 dollars is 0.008% of the value of a 400-ounce gold bar, while a little over 3% of the value of a 1-ounce bar.

The spot price of gold on your screen usually refers to the price of gold located in London—the most liquid spot wholesale market—in the form of 400-ounce bars. Products of lower weights than wholesale bars always enjoy a premium on top of the spot price. And products with high manufacturing costs, like coins, enjoy an even higher premium.

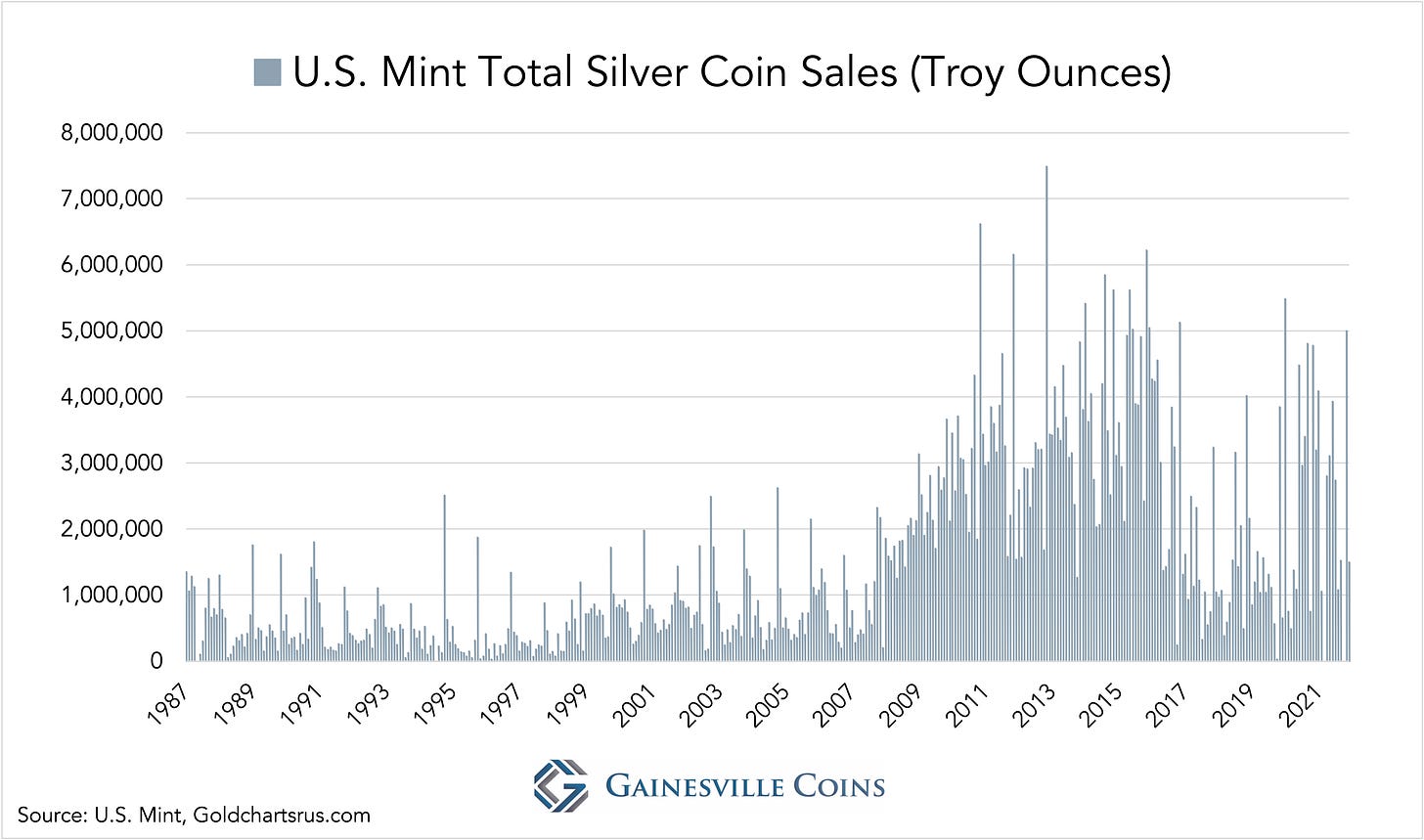

In the charts below you can see the sales figures of all U.S. Mint gold (and silver) coins since the 1980s. Clearly, gold coin demand is very volatile. In some months the U.S. Mint might sell as much as 250,000 troy ounces in coins, in other months not more than 10,000 troy ounces.

The silver coin market has more or less the same dynamics as the gold coin market.

How Modern Gold Coins Are Made

Like every factory, the U.S. Mint has a certain production capacity that can’t be adjusted on short notice. For fabricating gold coins, 400-ounce bars are rolled into sheets having the thickness of the series of coins the Mint wants to produce.

Next, blanks (“planchets”) are stamped from the sheets, after which these can be struck into coins using a die. Finally, the coins will be manually inspected for imperfections. In all, this is not a process that can be easily speed up or dialed down.

Watch this video to see how the United States Mint manufactures its bullion coins.

Understanding Gold Demand From a Global Perspective

When demand takes a nosedive, the Mint will lower its production capacity and add coins to its inventory. When demand increases all inventory is depleted and production capacity is increased, but it’s impossible for customers to get immediate delivery of their orders.

Coin supply is inelastic. A shortage of coins—not gold itself—causes coin premiums to rise above their averages. (For silver coins the average premiums are relatively higher as an ounce of silver is cheaper than an ounce of gold.)

Demand for gold coins must be seen as a retail sentiment indicator for a specific group of buyers. While premiums on gold coins in the U.S. can be sky high, gold in China can trade at a steep discount, versus London spot, as happened in 2020.

Consider that if for whatever reason there is a shortage of nails on one continent, this doesn’t mean the global price of steel should rise. Likewise, if gold coin demand in the West is high, this doesn’t mean the gold price should rise.

Because gold is a currency there can’t be a shortage of gold itself. But there can be a shortage of specific gold products at specific locations due to supply chain issues.